Source: Own elaboration

Analysis of Corporate Governance Regulatory Framework for Argentina

(*) Anahí Briozzo; (**) Diana Albanese; (***) Diego Santolíquido; (****) Agustín Argañaraz; (*****) Eliana Barco

(*) Business Management Sciences Department

Universidad Nacional del Sur IIESS (CONICET-UNS)

Bahía Blanca, Buenos Aires Province, Argentina

abriozzo@uns.edu.ar

(**) Business Management Sciences Department

Universidad Nacional del Sur Bahía Blanca, Buenos Aires Province, Argentina

dalbanese@uns.edu.ar

(***) Business Management Sciences Department

Universidad Nacional del Sur Bahía Blanca, Buenos Aires Province, Argentina

dsantoliquido@gmail.com

(****) Business Management Sciences Department

Universidad Nacional del Sur Bahía Blanca, Buenos Aires Province, Argentina

agustin.arganaraz@uns.edu.ar

(*****) Business Management Sciences Department

Universidad Nacional del Sur Bahía Blanca Buenos Aires Province, Argentina

ebarco@bvconline.com.ar

Reception Date: 12/11/2017 - Approval Date: 01/28/2017

ABSTRACT

Corporate governance (CG) describes how a company should be managed, directed and controlled, which involves the roles of shareholders and directors of the company, and the integrity of financial reports. The aim of this paper is to analyze the CG regulatory framework for companies that make public offer of their securities on the Stock Markets of Argentina. The mandatory requirements are studied comparatively with the recommendations of the Organization for Economic Co-operation and Development (OECD). The analysis is grouped according to five dimensions: 1) the composition and operation of the board, 2) transparency and integrity of information, 3) related parties, ethics, conflicts of interests and corporate social responsibility, 4) protection of shareholders, and 5) risk measurement, management, and disclosure. Relevant aspects are the right to equal treatment of shareholders, including minority and foreign shareholders; the obligation to appoint an audit committee, in order to ensure the integrity of reporting, accounting and financial reporting systems of the company, and the availability of appropriate control systems and, in particular, the emphasis on risk management systems. Finally, we observe overlap and duplication in reporting requirements, which takes us to consider the need for the revision of current legislation.

KEY WORDS: Corporate Governance; Regulation; Organization for Economic Co-operation and Development (OECD).

INTRODUCTION

Corporate governance (CG) describes how a company should be managed, directed and controlled. The low development of a capital market has a causal relation that acts in both directions with the quality of corporate governance. On the one hand, a weak CG reduces the demand for securities by investors and, on the other hand, the scarce development of the market discourages the entry of foreign investors due to the perception that an underdeveloped market does not reward good government practices. For these reasons, it is expected that in relatively weak institutional contexts, the contractual commitments assumed by the companies themselves will generate a greater benefit for them.

According to the OECD (Organization for Economic Cooperation and Development) the CG:

(...) is the system by which business corporations are directed and controlled. The CG structure specifies the distribution of rights and responsibilities among the different participants in the corporation, such as the board of directors, management, shareholders and other incumbents (stakeholders), and details the rules and procedures for making decisions on corporate matters. To do this, it also provides the structure through which the objectives of the company are determined, the means are assigned to achieve said objectives and it is determined how the performance is monitored in relation to the objectives pursued (Center for Financial Studies, CEF 2005, p.11).

The OECD's CG principles were developed considering that CG policies have an important role in achieving broad economic objectives, in relation to the investor confidence, and the training and the capital allocation. Together, CG standards and practices provide a framework to mitigate the distance between the savings of families and the investments in the real economy. As a result, it is expected that good CG practices will guarantee shareholders and other interested parties that their rights will be protected, and that companies can reduce their capital cost and obtain better access to capital markets.

The aim of this paper is to study the regulatory framework of the corporate governance of companies subject to the public offering regime in Argentina, particularly in the form of corporations, and to compare their requirements with the recommendations of the OECD (2015). The relevant aspects of Argentine legislation include the right to fair treatment of shareholders, including minority and foreign shareholders; the obligation to appoint an Audit Committee, in order to guarantee the integrity of the accounting and financial reporting systems of the company; and the availability of adequate control systems and, in particular, the emphasis on management risk systems.

The work structure is as follows: first, the CG principles of the OECD (2015) and the regulatory framework in Argentina are introduced to companies under the public offering regime. Subsequently, a comparative analysis is performed based on five dimensions: 1) composition and functioning of the board, 2) transparency and integrity of the information, 3) ethics, conflicts of interests and corporate social responsibility, 4) protection of shareholders and 5) measurement, administration and disclosure of risk. The work ends with the conclusions.

DEVELOPMENT

The principles of Corporate Governance of the OECD

The OECD issued, in 1999, its Corporate Governance Principles in which are the basic ideas that shape the concept, issuing a revised vision of them in 2004 and later in 2015.

The Principles represent a common basis that OECD member countries consider essential for the development of good governance practices. The Forum on Financial Stability described the Principles as one of the fundamental rules for guaranteeing sound financial systems (OECD, 2015). The principles are non-binding, and they seek to allow their application to identify and achieve the objectives of the organization in Appropriate governance framework. The State and the different agents of the economy are the ones who must decide how these principles should be applied when developing their own corporate governance frameworks.

The principles of the OECD (2015) are divided into the following chapters:

I) Guarantee the basis of an effective march for the CG: it seeks to promote transparent markets that allow the efficient allocation of resources. In the 2015 review, a new emphasis is placed on the quality of supervision and enforcement, and a new principle is included on the role of capital markets in the development of the CG.

II) The rights of the shareholders and key functions in the field of property: the fundamental rights of the shareholders are identified. The new aspects incorporated in the 2015 review include the use of information technologies in shareholders' meetings, the procedures for approving transactions with related parties and the participation of shareholders in remuneration decisions.

III) Institutional investors, capital markets and other intermediaries: this is a new chapter incorporated in the 2015 review, which addresses the need for economic incentives along the investment chain, with a particular focus on investors institutions that act as trustees. It also highlights the need to transparent and minimize conflicts of interest that may compromise the integrity of external analysts. Likewise, new principles are incorporated on the quotation of shares in foreign markets (cross border listings).

IV) The role of the stakeholders: active cooperation between companies and stakeholders is promoted, and the importance of recognizing the rights of stakeholders established by law or by mutual agreements is highlighted. The importance of access to information by stakeholders is mentioned, in a timely and regular manner, and their right to obtain compensation for the violation of their rights.

V) Disclosure of data and transparency: the key areas for the disclosure of financial and non-financial data are identified. New aspects incorporated in the 2015 review include recent trends with respect to non-financial information, which companies expose on a voluntary basis, for example in management reports.

VI) The responsibilities of the Board of Directors: the key functions of the board of directors are presented. The new aspects incorporated in the 2015 review include the role of the board in risk management, tax planning and internal audit. Likewise, new principles are incorporated with recommendations on the training and evaluation of board members, and on the establishment of committees within the board of directors, such as remuneration, auditing and risk management.

Although the Principles focus on open-ended companies, they can also be useful for closed-end companies. In the same way, while some Principles may be most appropriate for large companies, the OECD (2015) points out that policymakers in each country may wish to promote awareness of good CG practices for companies across the board. size.

It should be noted that Principles I and III, which refer to issues external to the firms, will not be analyzed in this paper, since the objective of this study is to analyze the regulations at company level, that is, that affects the taking of internal decisions about CG.

Regulatory framework of the CG in Argentina

Chisari and Ferro (2012) point out that in the 1990s, Argentina adopted a series of corporate governance rules similar to countries with an Anglo-Saxon legal tradition (Common Law), departing from the tradition of civil law to which it belongs. As of the year 2000, the reforms focused on the law of the stock market. The legal frameworks only imposed general guidelines, leaving the regulatory details in the hands of the National Securities Commission (CNV) .

With respect to the general legal regulations, Law No. 19550, previously known as the law of commercial companies, is now known as the General Corporation Law (GCL) as of the entry into force in August 2015 of the new Civil and Commercial Code of the Nation. (CCyO), sanctioned by Law No. 26994. Law No. 19550 lists the characteristics and requirements of the different corporate forms, including public limited companies (Articles 163 to 307). Specific requirements are established for the companies included in Art. 299, among which are those that make a public offer of their shares or debentures. These requirements include permanent state control, that the oversight committee be integrated with three trustees (Art. 386); collective bargaining (Art. 284), call for the assembly of shareholders within four months of the closing of the financial statements (EEFF) for approval (Art. 158), publication in large circulation newspapers of the offer of new shares via preferential subscription (Art. 194) and of the call to the shareholders meeting (Art. 237) and board of directors composed of at least three members (Art. 255).

The Center for Financial Studies (CEF 2005) indicates that Decree 677/01 of the National Executive Power (Transparency regime of public offer) signified a first and significant step in the adoption of good corporate governance practices for companies with public offer in Argentina. Although the reform had a positive reception in the market, the evidence indicates that there is ample scope to improve the Institutional CG in Argentina, including not only public offering companies but also companies without public offer and financial entities (CEF 2005). In this regard, one of the critical aspects is related not only to the existence of the appropriate institutional, legal and regulatory framework, but also to the effective application of laws and regulations (enforcement).

Law No. 26831, Capital Markets Law (CML), promulgated in December 2012, repeals Decree 677/01, Law No. 17811 (Public Offering Act, of 1968) and other regulations that oppose the same (Art. 154). The LMC dedicates its Title II Chapter III to the issuers (Art. 59 to 79), detailing the requirements for additional information in the RUs, administration, capital increases, call for meetings, transactions with related parties, duty of loyalty of the directors and operation of the audit committee. Title III Chapter I deals with the public offering (Articles 80 to 85), while Chapter II (Articles 86 to 90) regulates the public offer of acquisition, which must be addressed to all the holders of those shares, and the Chapter III covers the residual shares (Art 91. to 96). Chapter V establishes the transparency regime, where Section III is dedicated to external auditors and Section IV to the audit committee. Article 106 establishes that the CNV will monitor the activity and independence of the accountant accountants and external audit firms, and without prejudice to the competence of the professional councils regarding the monitoring of the professional performance of its members.

In the framework of the enactment of Law No. 26,831 (LMC), and its Regulatory Decree 1023/13, the CNV approved in September 2013 the new text of the Rules (NT2013), through the General Resolution CNV 622 / 2013 The current compendium of CNV regulations dated back to 2001. The CNV 2013 Rules are composed of 17 titles. As regards the CG, Title II refers to the Issuers, where Chapter II deals with the subject of shareholders' meetings and statutory amendments, in Chapter III the administrative and supervisory bodies, and the external audit, in Chapter IV the corporate audit, Chapter V the primary public offering and Chapter IX the contents of the Issuance Prospectus. Title III covers the withdrawal of the public offering and the public offer of acquisition, while Title IV refers to the periodic information regime.

With respect to the CG framework in particular, in October 2007 the CNV emi General Resolution 516 through which approves the minimum contents of a Corporate Governance Code (CGS) applicable to companies authorized to make a public offering of their shares (with the exception of SMEs) and establishes the obligation for their boards to include a report on the degree of compliance with said Code as an annex to the report of the Financial Statements as of the fiscal years beginning on January 1, 2008.

In May 2012, the CNV issued Resolution 606/12 modifying Resolution 516 / 07 regarding the contents of the Corporate Governance Code and also provides that it is mandatory for companies that are subject to the public offer of negotiable securities (issuers), excluding those that qualify as SMEs for the CNV, those enrolled in global debt securities issuance programs with repayment terms of up to 365 days, and cooperatives, associations, and trust issuers. Its application applies to the exercises initiated as of January 2012 As in the previous resolution, each company must self-assess its CG, informing if it still complies with the recommendations (totally or partially), in what way, or explain the reasons for which are not adopted. This amendment to the Corporate Governance Code includes nine principles:

1) Relationship between the issuer, its economic group, and its related parties: seeks to guarantee the disclosure of the applicable policies in these cases, the existence of preventive mechanisms of conflicts of interest and the prevention of the improper use of privileged information.

2) Administration and supervision of the issuer: it has the purpose of guaranteeing that the board assumes the administration and supervision of the company, to ensure an effective control of management, to make known the process of evaluation of the performance of the board of directors, that the number of directors external and independent is significant with respect to the capital structure; that there are standards and procedures for the selection of board members and front-line managers, and training and training programs for them.

3) Policy on identification, measurement, administration and disclosure of business risk: indicates that the company must have a specific policy in this regard, have a Risk Management Committee within the board of directors or general management; foresee the function of risk management officer or equivalent within the general management; permanently update the comprehensive risk management policies, indicating the conceptual framework used and communicate the results of comprehensive risk management in the financial statements and in the annual report.

4) Integrity of financial information and independent audits: it aims to guarantee the independence and transparency of the functions of the Audit Committee; of the Internal Audit and External Audit. The majority of the members of the audit committee must be independent and be able to read and interpret financial information and current accounting standards; there must be an internal audit function that reports to the committee or the chairman of the board of directors, that the committee members evaluate the external auditors on an annual basis, and have a policy regarding the rotation of the members of the audit committee and / or from the external auditor.

5) Respect for the rights of the shareholders: it intends that the shareholders have access to the information of the company, promote their active participation, guarantee the principle of equality between action and vote, establish mechanisms of protection against takeovers, encourage share dispersion, and ensure a transparent dividend policy.

6) Responsible link with the community: it is based on the maintenance of an open communication channel with the community, providing information on company issues; not only through mandatory reports but through the use of a website, which also serves to gather concerns from users. Also included in this point is the issuance of a Balance of Social and Environmental Responsibility with annual frequency and the intervention of an external auditor.

7) Fair and responsible remuneration: seeks to establish clear remuneration policies for board members and first-line managers, retention policies, promotion, dismissal and suspension of key personnel and guidelines for retirement plans, as far as possible through the implementation of a remuneration committee.

8) Business Ethics: aims to ensure ethical behavior, the implementation of a corporate code of conduct, mechanisms to receive complaints about illegal or unethical behavior, and specific policies for the treatment thereof. The inclusion of the principles of GS in the social position.

The two editions of the CGS of the CNV are based on the principle of complying or explaining. This principle is a central element of most codes of corporate governance in the world (Seidl, Sanderson and Roberts, 2013). It was originally proposed by the Cadbury Committee in the United Kingdom (Committee on Financing Aspects of Corporate Governance, 1992), and implies that companies can comply with the requirements of the code or explain why they do not. Subsequently, a large number of countries issued their own codes of good practice, with the first Latin American countries to do so in Brazil and Mexico, in 1999 (Fornero, 2007) and Argentina in 2004 through the Argentine Institute for Corporate Governance (IAGO, 2004).

Comparative normative analysis

In this section, a comparative analysis of the current regulations on corporate governance in Argentina is carried out, applicable to companies that issue negotiable securities, and that are therefore under the control of the CNV.

For this purpose, the requirements were grouped into five dimensions:

The first four dimensions correspond to the classification of aspects of the CG carried out in previous studies for Latin America (Leal and Carvalhal-da-Silva, 2005, Garay and Gonzalez, 2008), and the fifth dimension of risk management is added, depending on the relevance given to this topic in Res. CNV 606 / 12. For each dimension of the CG, a comparison of Argentine regulations and OECD principles is made.

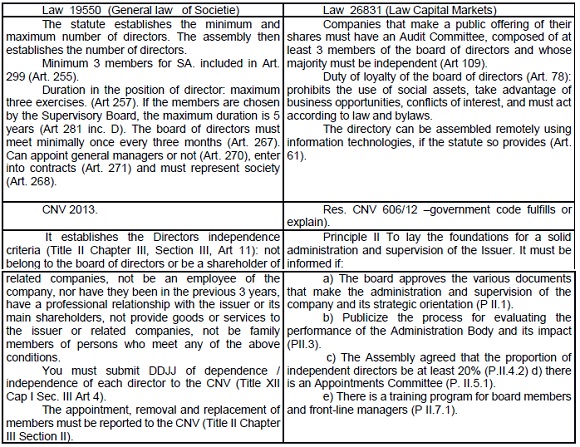

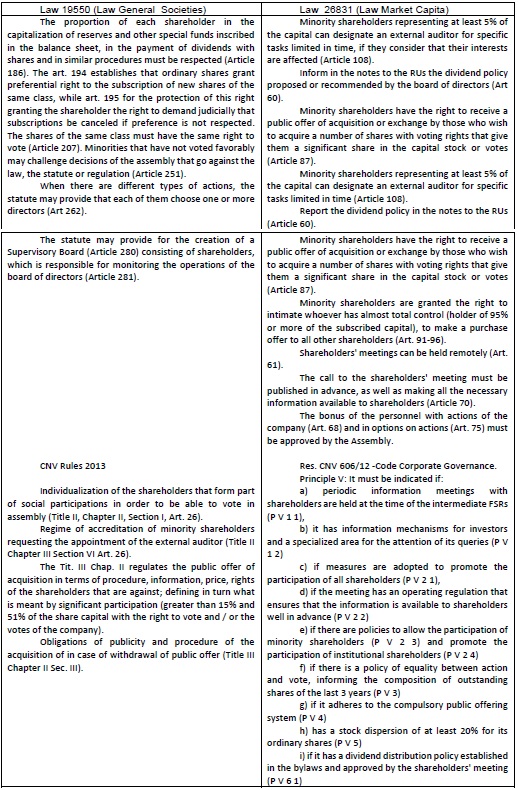

Table 1 describes the characteristics required of the board in terms of number of members, independence status, board committees, appointment deadlines, among others, provided by Argentine regulations.

Table N° 1. Composition and functioning of the Directorship

Source: Own elaboration

As regards the principles of the OECD, it is worth mentioning that the Board covers both the Supervisory Board that some countries have and the Board of Directors, which refers to the main executives. In Argentina, the functions of the Board of Directors would be equivalent to the board of directors (OECD, 2004). OECD Principle VI (2015) addresses the responsibilities of this body, and establishes that the Board of Directors must perform the following key functions: 1) the review and orientation of the company's strategy, the main action plans, the risk policy, annual budgets and company plans; the establishment of objectives in terms of results; control of the planned plan and the results obtained by the company; supervision of capital disbursements, acquisitions and disinvestments of a greater amount, 2) control of the effectiveness of the company's governance practices, and the introduction of necessary changes, 3) selection, remuneration, control and substitution of the main executives, and the supervision of the succession plans, 4) the alignment of the remuneration to the main managers and members of the Board with the interests of the company and of the long-term shareholders, 5) guarantee the formality and transparency of the process of proposal and election of the members of the Board, 6) the control and management of potential conflicts of interest between directors, board members and shareholders, including the misuse of the assets of the company, 7) guarantee the integrity of the accounting and financial reporting systems of the company, including the independent audit, and the availability of control systems and, in particular, of risk management, financial and operational control systems, and ensure the adequacy of these systems to the applicable law and regulations, 8) supervision of the data disclosure and communications process, 9) establish specialized committees, especially in relation to auditing, and depending on the size and risk profile of the company, risk management and compensation.

The Argentine regulations give special importance to the role of the audit, since the Capital Markets Law establishes the obligation to appoint an Audit Committee, with an emphasis on guaranteeing the integrity of the accounting and financial reporting systems of the company, including the independent audit, and the availability of adequate control systems and, in particular, of risk management systems, of financial and operational control. The other aspects are incorporated on a voluntary basis, as Res. CNV 606/12 requests to indicate if there is an Appointments Committee, the proportion of independent directors and the participation of the board in different matters of the strategic management of the company.

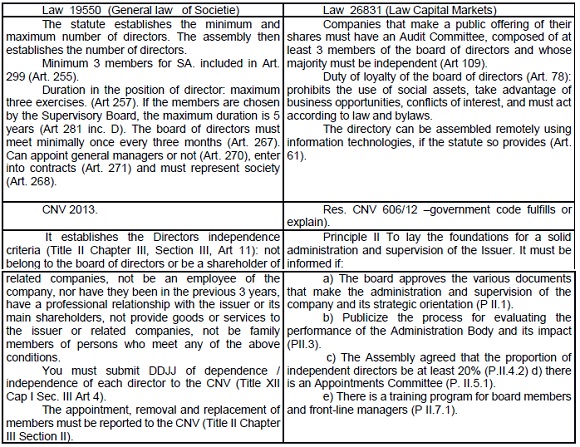

Table 2 compares the requirements regarding transparency and information integrity.

Table N° 2. Transparency and integrity of information

Source: Own elaboration

These contents are expressed in part in Principle V of Disclosure and Transparency of the OECD, which states that the CG:

- It must ensure the timely and accurate disclosure of all material issues relating to the company, including the financial situation, results, ownership and governance of the company.

- The information to disclose must include as a minimum: the financial and operating results of the company, its objectives, the ownership of the large groups of shares and voting rights, the remuneration policy of the members of the Board and senior managers, its merits, selection process and the positions held in other companies and if they are considered independent by the Board, transactions between related parties, foreseeable risk factors, issues related to employees and other interested parties, corporate governance structures and policies. The disclosure channels must guarantee equal, timely and affordable access by users to the information of interest.

- The reports must be prepared and disclosed in accordance with high quality standards in accounting and disclosure of financial and non-financial information.

- An annual audit must be carried out by an independent, competent and qualified auditor in order to offer Board members and shareholders an external and objective guarantee that the financial statements faithfully reflect the financial situation and results of the company. in all its significant material aspects. It is considered good practice for the independent auditor to be proposed by an independent audit committee or similar.

- Finally, the disclosure of data and transparency should be complemented by an effective approach that foresees and promotes the availability of an analysis or advice by analysts, brokers or rating agencies, which could be of interest to investors at the time to take decisions; and they should be free of possible conflicts of material interests that could compromise the integrity of their analysis or advice.

In particular with respect to the requirement of independence of the external auditor, implies that the accountant must perform their work objectively, without being influenced by external events, or restrictions or limitations related to their feelings or relationships with their peers. The principle of independence is exclusive so that a public accountant enrolled in the respective Professional Councils, perform assignments of audit of financial statements, as regulated by Technical Resolution 37 of the Argentine Federation of Professional Councils in Economic Sciences (FACPCE) and the code of Unified Ethics of the same organism. The auditor must not only be independent in terms of compliance with the regulatory provisions and professional code of ethics, but also in the eyes of the users of the accounting information (OICV-IOSCO, 2002).

The independence of the external auditor is mandatory according to Law 26,831 (Capital Markets); The definition of the corresponding independence is regulated in the CNV 2013 Rules (Title II, Chapter III, Section VI, Article 21). In Argentina currently live the accounting standards issued by the FACPCE, called Technical Resolutions (RT) which are then approved by the respective Professional Councils, the International Financial Reporting Standards (IFRS) and the IFRS for SMEs. Companies that are under the control of the CNV (except PyMES) are required to apply IFRS in the preparation of their financial statements, which guarantees higher quality of information to users and the use of common standards in force in most countries developed. The Code of Unified Ethics (CEU) of the FACPCE (2000), the basic characteristics that the accountant must have to comply with the objectives of the profession, the highest possible level of execution and satisfy the requirements of the public order, exhaustively listing a series of situations in which there is a lack of independence.

With regard to information on remuneration, the remuneration committee is voluntary in Res. CNV 606/12. The background information of the members of the board, management and remuneration should be included in the prospectus for the issuance of securities (CNV 2013 Rules, Title II, Chapter IX, Annex I, points 5 and 6), which is why it is not available in periodical.

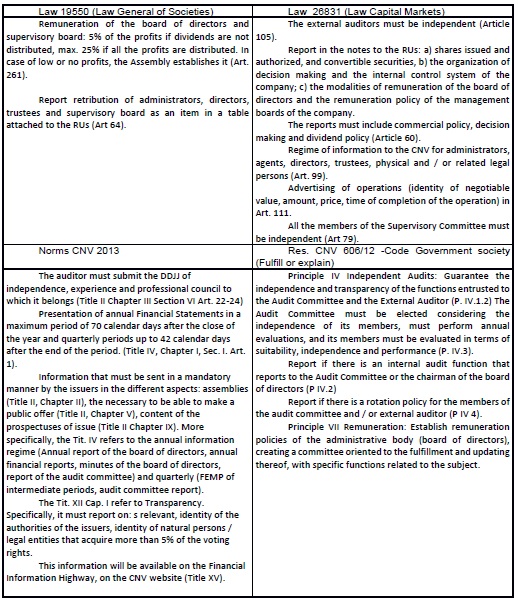

The third dimension defined for the comparative analysis of Argentine regulations is Related parties, ethics, conflicts of interest and CSR, which is set out in Table 3. It covers social and environmental responsibility, both of directors and managers, and management policies. Conflicts and regulations on contracts with interested parties.

Table 3. Ethical Related Parts related, etics, conflics of interests y RSE

Source: Own elaboration

As can be seen in Table 3, the standards emphasize the links between related parties specifying what is meant as such. Aspects related to ethics, conflicts of interest and CSR are not contemplated in Law 19550. Argentine regulations address this issue only for companies under a public offering regime, although conflicts between interested parties can not be considered to be limited to this area.

Principle IV of the OECD referring to the role of interested parties in the CG, proposes that:

- The rights of interested parties established by law or through mutual agreements should be recognized, and active cooperation between societies and stakeholders should be encouraged with a view to creating wealth and employment, and facilitating the sustainability of healthy businesses from the point of view of financial view

- The participation of employees should be promoted, in the directory or through specific committees.

- Interested parties that participate must have timely and regular access to relevant, sufficient and reliable information; being able to freely express to the Board of Directors their concerns regarding possible illegal or unethical practices and their rights should not be compromised by making this type of demonstrations.

- In processes in which cases of insolvency are presented, the framework for corporate governance must be effective, effective and through the effective application of the rights of the creditors.

The Argentine regulatory framework gives special importance to the treatment of transactions with related parties. The aspects of communication mechanisms and conflict resolution only appear on a voluntary basis in the CGS. It does not mention, unlike the principles of the OECD (2015) that employees must have mechanisms that favor their participation.

Table 4. Protection of the shareholders

Source: Own elaboration

Regarding the rights and equal treatment of shareholders and their key functions, Principle II of the OECD (2015) indicates that the CG:

- It must guarantee fair treatment for all shareholders, including minority shareholders and foreigners. These should have the opportunity to make an effective remedy in case of violation of rights.

- All shareholders of the same series within a category must enjoy equal treatment. Minors should be protected against abusive acts or special interest of shareholders with control power. The use of privileged information and the abusive operations of treasury stock should be prohibited.

- Likewise, the members of the Board and the senior executives must be required to inform the Board of any material interest they may have directly, indirectly or on behalf of third parties, in any transaction or matter that directly affects the company.

- It must protect and facilitate the exercise of the rights of the shareholders. Among them, the rights to ensure methods to register their property, assign or transfer shares, obtain relevant and substantive information about the company in a timely and regular manner, participate and vote at the shareholders' meetings, elect and revoke the members of the Board and participate in the benefits.

- They must also have the right to be informed and participate in decisions referring to fundamental changes in society: changes in bylaws, authorizations to issue new shares and extraordinary transactions that involve the sale of the company in whole or in part.

- They must also have the opportunity to participate and vote at the general shareholders' meetings, they must be informed about the modality thereof and the voting procedures. Shareholders must be informed sufficiently in advance about the day, place and agenda of the shareholders' meeting, and allow fair treatment of all shareholders. It should be sought that it is not difficult or costly to cast the vote, for example allowing the use of information and communication technologies, in particular to allow the participation of foreign shareholders.

- Remuneration through actions of the board of directors and employees must be approved by the shareholders' meeting.

With respect to the following OECD recommendations made in Principle II:

- The corporate control markets must be able to function efficiently, transparently and facilitate the exercise of property rights by all shareholders, including institutional investors.

They are reflected in the Argentine regulations only for those companies under a public offering regime, which is consistent with the scope of application of both recommendations.

As shown in Table 4, the protection of shareholder rights is a topic widely discussed in Argentine regulations. The right to fair treatment of shareholders, including minority and foreign shareholders, to participate in decisions regarding fundamental changes in the company and to be informed of changes in the bylaws, the authorizations for the issuance of new shares, extraordinary transactions involving the sale of the company totally or partially are aspects contemplated in Law 19550 and are mandatory for all companies. The regulation is more detailed for companies under a public offering system, since in this case it is especially important to protect the rights of minority shareholders. With respect to agreements and capital groupings that allow certain shareholders to acquire a disproportionate degree of control in relation to the shares they own, they are reflected in the Argentine regulations only for those companies under a public offering regime. The announcement of the call and relevant information about the shareholders' meeting is foreseen in the LMC, as well as the possibility of remote participation. The approval of the Shareholders' Meeting is also mandatory.

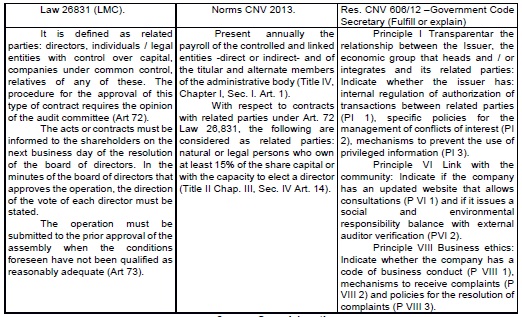

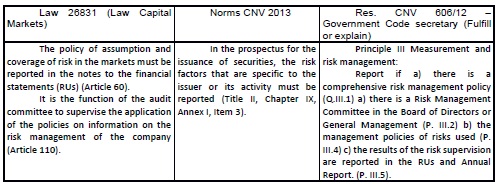

Finally, Table 5 presents the normative approach in matters of risk management.

Table 5. Measurement, Administration, and risk disclosure

Source: Own elaboration

Law 19950 does not contemplate risk management. In the OECD principles this point is incorporated in the 2015 revision, but it is not given the principle level. In Principle VI of the OECD (2015) it is mentioned as the responsibility of the Board of Directors to supervise risk management systems, and to ensure the implementation of adequate risk management systems. In this regard, both the Capital Markets Law and the CNV postulate more specific requirements than the OECD framework, when requesting information in the notes to the RUs and the prospectus, and include in the CGS a principle dedicated to this topic, with specific aspects such as the existence of a risk management committee and the description of the adopted policies. This differential emphasis of Argentine legislation on risk management can be explained by the different context of application, since while the OECD principles (2015) were designed for countries with a higher degree of development, in emerging countries such as Argentina the factors of risk have special relevance in the investment decisions of the participants of the capital market.

CONCLUSION

The analysis of the normative framework for Argentina in a comparative way with the OECD CG Principles addressed in this paper intends to be a contribution to the need to deepen the study of the differences in the structures of the markets, regulatory framework and role of the formal and informal institutions.

The Argentine norms deal extensively with the protection of shareholders' rights; they give special importance to the selection, retribution, control and independence policies of the members of the board of directors; they promote the integrity and reliability of the company's accounting and financial reports, including the independent audit, and the availability of adequate control systems. It should also be noted that the regulatory framework of the CNV and the Capital Markets Law post more specific requirements than the OECD framework with regard to risk management.

There are some aspects in which the principles of the CGS (Res CNV 606/12) postulate less precise requirements than the 2013 CNV Rules. For example, while principle II.4.2 of the CGS requests the company to indicate whether the shareholders' meeting agreed to that the proportion of independent directors be at least 20%, CNV 2013 standards request to present a sworn statement of the dependency / independence character of each member of the board. In this way, the precise information on the integration of the directory is outside the CGS, which means an additional effort in the search of information by investors. On the other hand, Principle IV.4 of the CGS requests to indicate if there is a policy of rotation of the external auditor, when the CNV 2013 Rules establish the obligation of rotation every three years of the association or study that performs the audit.

Currently, the issuers carry out the generation of information on CG, and face the costs associated with the implementation of the requirements, but the dissemination of the data in different documents (financial statements, prospectuses of issuance, sworn statements submitted to the CNV, etc.) would seem to lead to inefficient results in terms of information transparency. Considering that one of the principles of the OECD (2015) is to ensure access to information in a timely and regular manner for all stakeholders, it would be convenient to review the CGS (Res. CNV 606/12) in light of the requirements of CG raised in CNV 2013 Rules, so that all the information referred to the CG is concentrated in a single document, easy to consult for all interested parties, regardless of the additional surrender requirements established by the CNV.

REFERENCES

Please refer to articles in Spanish Bibliography.

BIBLIOGRAPHCIAL ABSTRACT

Please refer to articles Spanish Biographical abstract.