Esta obra está bajo una Licencia Creative Commons Atribución-NoComercial-SinDerivadas 2.5 Argentina

CORPORATE SOCIAL RESPONSIBILITY: FINANCIAL INCLUSION IN THE ECUADORIAN PRIVATE BANKING SYSTEM

Galo Ramiro Acosta Palomeque

_________________________________________________________________________________________________________________________________________________________________________

Corporate social responsibility: financial inclusion in the ecuadorian private banking system

Galo Ramiro Acosta Palomeque

Departamento de Ciencias Económicas, Administrativas y de Comercio

Universidad de las Fuerzas Armadas ESPE

Sangolquí, Pichincha, Ecuador

gracosta@espe.edu.ec

Reception Date: 04/27/2018 - Approval Date: 07/08/2018

ABSTRACT

According to the World Bank, it is estimated that more than 2 million adults, on the planet, do not have an account to transact, more than 200 million micro, small and medium enterprises lack businesses. According to Global Findex in Ecuador, approximately, 46.2% of the Ecuadorian population over 15 years of age had an account in a formal financial institution in 2014. The objective of this study is the financial inclusion in the Ecuadorian private banking system based on sustainability reports of the year 2016. In the research, a methodology of documentary and descriptive research was used for the elaboration of the theoretical framework, while for the empirical study the methodological scheme of the transversal-type phenology was used and 4 financial institutions. The analyzed financial institutions present an instrumentalist approach to corporate social responsibility. The evidence suggests that, starting with the 2008 Constitution, a regulatory and institutional environment for financial inclusion has been formed. Finally, during 2016 there was an improvement in the use and access to financial products and services.

KEY WORDS: Financial inclusion; Sustainability reports; Corporate social responsibility; Bank System.

INTRODUCTION

In recent years, financial inclusion (FI) has become an important research topic. The OECD (2013) defines the FI as timely and adequate access to a range of regulated products and services and the increase of its use by all segments of society. In the global context, the FI is so relevant that it is listed as a goal of the Sustainable Development Goals (SDGs) of the 2030 Agenda approved by the United Nations (UN). The World Bank promotes universal access to financial products and services by 2020 (UFA 2020).

According to the World Bank (2016) it is estimated that more than 2 billion adults in the world do not have a basic account to carry out their transactions; more than 200 million MSMEs lack the adequate financing to grow and prosper. In Ecuador, the use of financial services in recent years has advanced moderately. According to the latest data from Global Index World Bank show that e n 2014 approximately 46.2% of the 15 - year Ecuadorian population had an account at a formal financial institution, while the average in Latin America and the Caribbean was 51.1%, and 70.4% in countries with high average incomes.

Thus, the objectives of this paper consisted in carrying out a document review analysis of the variable’s corporate social responsibility and financial inclusion, as well as evaluating the financial inclusion in 4 large Ecuadorian banks based on the sustainability reports of 2016.

The rest of the document is organized as follows: section 1 describes the methodology used to carry out the documentary and empirical studies. Section 2 reviews the theoretical framework related to social responsibility and financial exclusion. Section 3 collects the empirical results and finally the main conclusions are presented.

DEVELOPMENT

1. Methodology

1.1 Documentary study:

In the theoretical framework, a methodology of documentary and descriptive research was used, given that the procedure involves the search, organization, systematization and analysis of documentation on corporate social responsibility (CSR), financial inclusion, guides and indicators of social responsibility at the general and financial sector, and regulatory environment of financial inclusion in Ecuador.

The units of analysis were all the documents on the subject found in the databases of official organisms, Financial Institutions and Google Scholar. Res corporate social - responsibility, financial inclusion, global pact, objectives sustainable development, Global reporting: as search criteria, the following descriptors were included initiave, sustainability reports, among others. These descriptors were combined in different ways to expand the exploration criteria. When searching for information, 49 sources were chosen as physical and digital books; articles indexed databases; laws, resolutions, regulations and these documents were systematically reviewed.

For the organization of the documents a database was created with the following fields: title of the publication, author, year, editor, objectives, type of research, method, results and thematic core. Once the information was organized, the documents were grouped by thematic nuclei. Subsequently, the analysis of each of the thematic nuclei was carried out. Finally, a global analysis was carried out through which the strengths and weaknesses of financial inclusion in Ecuador were identified and certain conclusions were made.

1.2 Empirical study

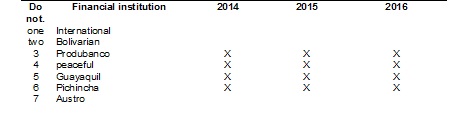

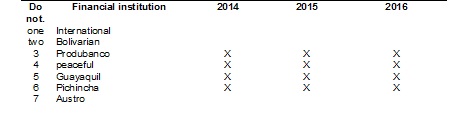

The study was carried out under the methodological scheme of phenomenology, it is transversal and the sample is non-probabilistic in nature. In the first place, the 23 Ecuadorian banking institutions were classified according to their size according to the financial ranking developed by Ekos. In this sense, Ekos used the CAMEL methodology and the financial statements for the year 2016. The number of banks segmented by their size is presented in table N ° 1.

Table N ° 1. Segmentation of banking entities by their size

Source: Own Elaboration based on Ekos (2017)

Secondly, it was reviewed in the websites of the large banking institutions that published the sustainability reports in the last 3 years, obtaining the results that are shown in the Table N ° 2.

Table N° 2. Large banks that publish sustainability reports

Source: Own Elaboration

In this study, corporate social responsibility was analyzed, punctually, the topic of financial inclusion. The financial institutions Produbanco, Pacífico, Guayaquil and Pichincha were chosen, which published the Sustainability Report d in 2016. According to Ekos (2017) private banks represent 80% of the total financial system, while the seven large banks 88% of the total banking system and 70% of the private financial system.

2. Review of the Literature

The literature review was conducted on two main variables that address the research: corporate social responsibility (CSR) and financial inclusion (IF); then n is defined each.

2.1 Corporate social responsibility (CSR)

Corporate Social Responsibility (CSR), understood as an ethical way of managing organizations, particularly financial institutions, guides their activities taking into account the expectations of thedifferent stakeholders affected by their actions (shareholders / investors, customers, collaborators and their families, community, environment and government); contributes to sustainable development.

The most agreed definition at a global level is generated by the International Organization for Standardization ISO (2010), refers to social responsibility as an ethical and transparent behavior in decision-making and in business activities that have an impact on society and the environment, which contributes to the sustainable development and well-being of the community, that takes into account the expectations of the interested parties, that complies with current legislation and is consistent with the international norms of socially responsible organizational behavior. The importance of transparency in business today that, together with ethics, demand a business action in accordance with the needs of the environment (Marulanda, 2014).

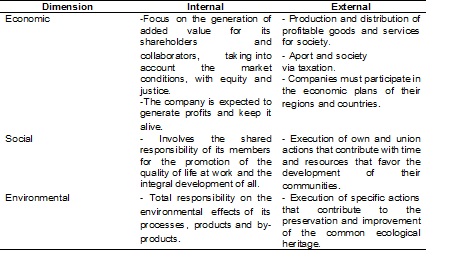

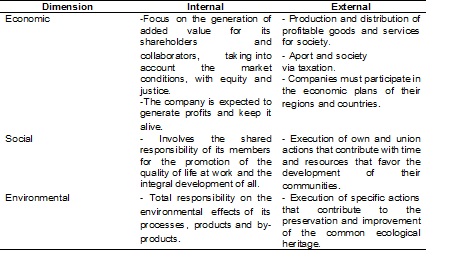

The triple bottom line (triple bottom line) coined by Elkington (1994) is a term related to sustainable business, which refers to the performance of a company expressed in the social, environmental and economic dimensions, which allows an internal and external visualization of a organization.

The triple bottom line (TBL) went beyond the traditional measures of profit s, return on investment and value for the shareholder by including the social and environmental dimensions. The TBL is calculated mostly in terms of an index, with the advantage that it allows comparisons between companies, cities, development projects, among others (Slaper & Hall, 2011). The main characteristics of these three dimensions are shown in Table no.3.

Table N ° 3. Dimensions of the CSR

Source: Prepared from Cajiga (2013)

For Noé, Buraschi and Peretti (2015), CSR is based on answering, mainly, the demands originated in the social and environmental dimensions, trying to integrate them with the primary economic objective of profitability. If companies viewed CSR strategically, it would be a source of opportunities that would generate a competitive advantage and benefits in terms of corporate citizenship, working cooperatively with their suppliers, customers, competitors and other interested parties (Elkington, 1994).

Rivera and Malaver (2011) group social responsibility into the following four approaches: a) instrumental theory, b) political theory, c) integrative theory and d) ethical theory. The instrumental approach considers CSR as a strategic tool for the creation of value and social activities as a means to achieve economic results. It is divided into three subcategories: a) Maximizing value for shareholders; b) Strategies to achieve competitive advantages and c) Marketi ng related to some cause (Rubio & Fierro, 2016). Companies assume ethical and responsible behavior to the extent that they obtain competitive advantages.

2.2 Financial inclusion

The World Bank (2016) refers to financial inclusion as the accessibility that companies and individuals have to a range of financial products and services that meet their needs and that are provided in a sustainable and responsible manner. This perspective has many dimensions depending on the amount of services that are incorporated and is directed differently to individuals and companies. Access to financial services, such as the opening of a savings account, facilitates the use of electronic means of payment, the realization of transfers, the generation of savings, and by creating a collateral the possibility of accessing loans, insurance and more elaborate financial products (Cueva, 2012).

Financial inclusion is related to the theory of the base of the pyramid proposed by Prahalad (2005), which is that companies must take into account the low-income population as potential consumers, suppliers, distributors, partners or employees, since they represent an opportunity to eradicate poverty while generating profitability. In this sense, inclusive businesses (NI) are sustainable business initiatives with the potential to significantly improve the living conditions of the population at the base of the pyramid (Bpd), while being economically profitable and environmentally viable (Pineda, 2014).

For Prahalad (2005), the poor market would allow exploiting the so-called economies of scale in cellular telephony, health services and massive loans. In Ecuador as of March 2016, the poor population represented 25.35% of the total. An example of inclusion of the population of the base of the pyramid in Ecuador has to do with the expansion of the mobile telephony market, as of December 2017 there were 14,651,404 active lines at the national level of mobile telephony service, representing a of penetration of 89%. The greater access to telecommunications has allowed independent workers to carry their offices, gain markets and efficiency.

According to Levine, Loaiza and Beck (2000), the importance of the impact of financial inclusion on the development of a country is evidenced by a high positive correlation between access to financial services and the economic growth of the countries. According to Sahay, Cihák, N'Diaye and Barajas (2015) in the 2000s, empirical studies on this construct evolved with the application of the statistical technique of panel data with lagged values in the financial variables and controlling the effect of others determinants of growth. Aizenman, Jijarak, and Park (2015) analyze data at sector level of 41 economies, determine that financial deepening increases economic growth but only to a certain extent, in addition, to have heterogeneous effects among different sectors. The greatest economic growth occurs, thanks to the increase in consumption capacity and the expansion of investment by the excluded population.

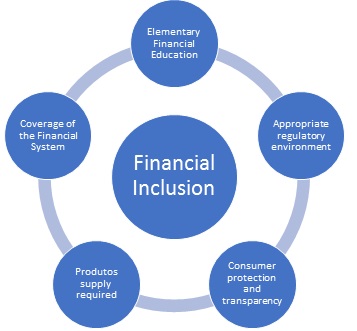

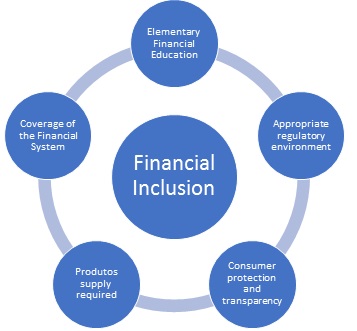

Financial inclusion is a concept that encompasses several complementary elements seen in Figure No. 1: a) a suitable regulatory environment, b) a product offering favorable (means of payment, savings, credit and insurance), c) coverage of the financial sector, with access to all transactional channels to receive quality services at fair prices, d) promotion and dissemination of financial education and e) adequate consumer protection of financial services and transparency in information.

Figure N ° 1. Elements of Financial Inclusion (IF)

Source: Elaboration from Moya (2011)

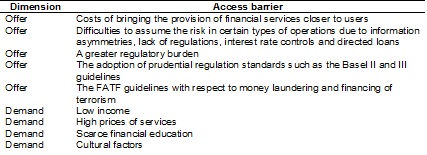

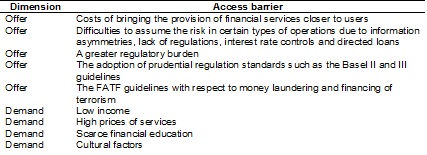

The micro, small, and medium-sized enterprises (MSMEs), in general, face different barriers to access the financial system, as do the lower-income population. Barriers to financial inclusion are classified from the supply and demand as observed in Table No. 4.

Table N ° 4. Barriers to access to the financial system

Source: Prepared based on Guerrero, Espinosa and Focke (2012)

Combined supply and demand, determine the segment of the population that can be bankized. In this sense, for Guerrero, Espinosa and Focke (2012) an inclusive financial system means making all types of financial services available to companies and people with lower incomes, such as opening accounts, sending remittances, savings, micro-credits., credit cards, housing loans to insurance.

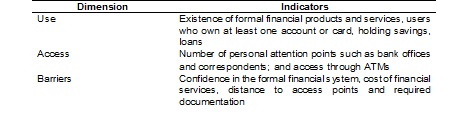

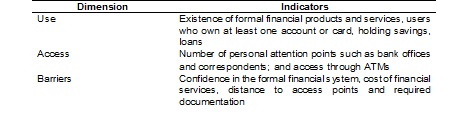

Multidimensional index of financial inclusion (MIFI): The MIFI is used to compare the levels of financial inclusion among the economies of the countries in time. An inclusive financial system maximizes access and use, while minimizing the barriers that limit financial inclusion (Cámara & Tuesta, 2014). In this regard, the IFIMs evaluates three dimensions: the use, access and barriers by indicators.

shown in T able No. 5. The weights assigned to tell are determined by the statistical technique of principal component analysis in two stages.

Table N ° 5. Multidimensional index of financial inclusion (MIFI)

Source: Prepared based on Cámara y Tuesta (2014)

The Multidimensional Index of Financial Inclusion in 2014 was calculated for 137 countries, based on both information on the demand side using the Global Findex data, and on the basis of the financial access survey of the International Monetary Fund. In Latin America, the 10 first countries in financial inclusion according to the 2014 MIFI are presented in the TABLE No. 6; As can be observed, most have a medium level of financial inclusion.

Table N ° 6. Ranking of Financial Inclusion MIFI 2014 in Latin America

Source: Prepared based on Cámara y Tuesta (2014)

For Cámara y Tuesta (2014) the degree of financial inclusion of the countries is highly correlated with the following variables: GDP per capita, financial education, efficiency of the financial system andfinancial stability.

2.3 Guides and indicators of social responsibility at a general level

Social responsibility guidelines guide the efforts of all actors to move towards a sustainable development focused on equality. The main initiatives to which the organizations are affiliated are the Global Compact and the Sustainable Development Goals (SDG), among others.

The Global Compact: The Global Compact is a voluntary initiative, in which companies make a commitment to align their operations and strategies with the ten principles in the areas of environment, human rights, labor standards and anti-corruption, as well as contribute to the Objectives of Sustainable Development (ODS). According to United Nations Global Compact (2018) by its number of participants, 9704 companies in more than 161 countries, the Global Compact is the largest initiative in the world. The member organizations are assured that practices based on universal principles contribute to a more inclusive, stable and equitable world market (Pact Global Net Colombia, 2018).

Sustainable Development Goals (SDG): In September 2015, the General Assembly of the United Nations approved the 2030 Agenda for Sustainable Development, integrating 17 goals and 169 goals. According to the United Nations (2016), this agenda seeks a transformation towards the social, economic and environmental sustainability of the 193 member states. It is a guide for the work of the organizations, it constitutes an opportunity for Latin America and the Caribbean, because it includes priority issues such as the reduction of inequalities, promotes inclusive economic growth with decent work, among others. In the case of Latin America and the Caribbean, where most countries are considered to be of medium income, financing for the 2030 Agenda will have to be covered by private and public resources and by innovative sources.

The sustainable development objectives, hereinafter SDOs, place special emphasis on curbing the increase in inequality, especially in the economic sphere. In this regard, financial inclusion is promoted as one of the main priorities until 2030. SDG 8, promoting sustained, inclusive and sustainable economic growth, is related to financial inclusion, specifically, with goal 10, which consists of strengthen the capacity of financial institutions in countries to increase accessibility to formal financial and insurance services until 2030. (Nations United, 2018).

For Rodriguez and Segura (2013) the indicators of responsible management have been generated so that companies are recognized as socially responsible and their purpose is to measure the fulfillment of their objectives in each of the dimensions of CSR. In Ecuador, companies use Global Reporting Initiative (GRI), ISO 26000 and the Do w Jones sustainability index (DJSI), among others.

Global Reporting Initiative (GRI): Global Sustain ability Standards Board (2016) mentions that GRI standards for the preparation of sustainability reports have been designed for organizations to present information on their impacts on society, economy and the environment. The GRI standards have been developed, mainly, to be used as an interrelated set that helps in the preparation of sustainability reports to organizations of any type, sector, size or geographical location.

ISO 26000: ISO 26000 is an International Standard that provides guidance on social responsibility. It is designed for all types of organizations, both public and private in all countries. The norm helps organizations to function in a socially responsible manner in an increasingly demanding society. ISO 26000 consists of voluntary guidelines, but not requirements, so it should not be used as a certification standard (ISO, 2010). According to Glob al Reporting Initiative (2011) there is a relationship between the guidelines of the GRI to prepare the sustainability reports and the Social Responsibility (RS) guidelines of the ISO 26000 standard.

Dow Jones Sustainability Index (DJSI): It is a global index that values good sustainability practices of companies based on social, environmental and economic criteria. This index has become a point of reference for investors who take sustainability criteria into account when investing in the stock market (RobecoSam, 2018).

Ecuadorian banks have been adopting these guidelines and management indicators within their activities, for example, Banco Pichincha has been adhering to the Global Compact initiative since 2011, committing itself since then to align its sustainable management model with the 10 universally accepted principles. Likewise, for the preparation of sustainability reports, Ecuadorian banks are subject to the guidelines of the Global Reporting Iniative (GRI).

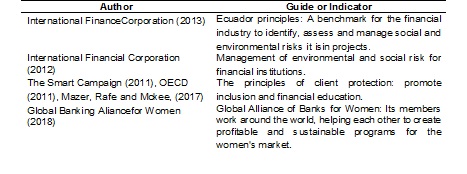

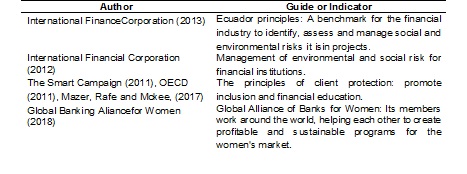

2.4 Guidelines and indicators of social responsibility in the financial sector

With regard to the responsible management of the financial system, guidelines and indicators have been developed worldwide to promote sustainable development in areas such as those indicated in table N ° 7.

Table N ° 7. Guides and indicators in the financial sector

Source: Own Elaboration

3. Results

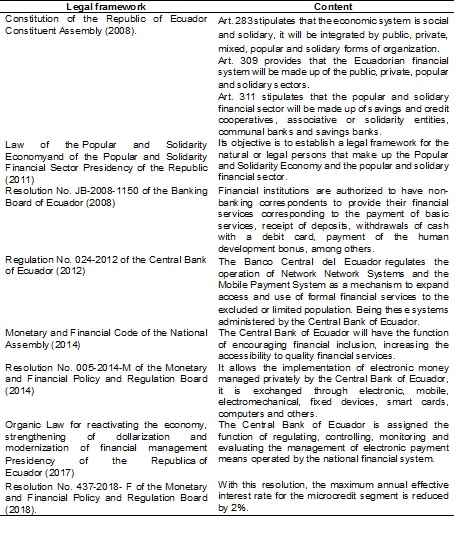

3.1 Regulatory environment of financial inclusion in Ecuador

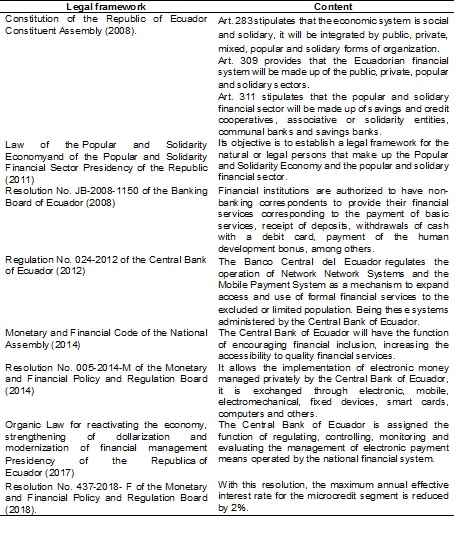

Ecuador has a long history in institutions dedicated to microfinance, linked, mainly, to cooperativism. The trade associations and cooperatives date from 1879 to conform in the city of Guayaquil, the Society of Artisans Lovers of Progress. In 2002, according to the Rural Financial Network (RFR) 15 non-governmental organizations and 2 banking institutions were engaged in the microcredit segment, granting 95,124,993 dollars to serve around 192,849 clients. However, financial inclusion in the Ecuador formally begins with the Constitution in force since 2008, henceforth has been configured the current legal framework that is presented in the Table No. 8.

Table N ° 8. Regulatory framework of financial inclusion in Ecuador

Source: Own elaboration, based on sustainability reports

In Ecuador during the period 2008-2018, the new legal framework establishes the bases for the development of financial inclusion, authorizing financial institutions to have non-banking correspondents. By means of resolutions of the competent authorities, interest rates are reduced, such as the costs of financial services. The electronic money managed in the first instance by the Central Bank of Ecuador is implemented, subsequently, due to the unattractive nature of this means of payment, its management is transferred to financial institutions. Finally, Ecuador ranked 25th in the Global Microscope 2016 ranking prepared by (EIU (Economist Intelligencex Unit), 2016) of the best regulatory and institutional environments for financial inclusion worldwide.

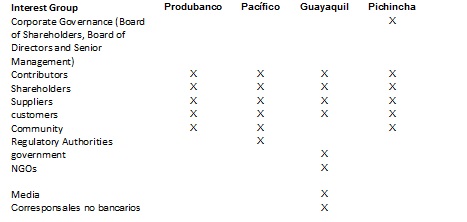

3.2 Interest groups in the Ecuadorian banking sector

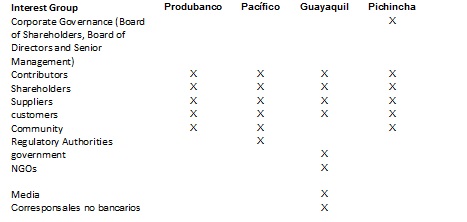

In financial institutions, interest groups are the central axis of corporate social responsibility. Stakeholders are those individuals or groups of individuals who have an interest in the organization, who may need something from it or who may affect or be affected by the activities performed. According to the sustainability reports of the 4 financial institutions analyzed, the interest groups identified are shown in table N ° 9.

Table No. 9. Stakeholders in the Equatoria banking sector not

Source: Prepared by the authors, based on Produbanco (2016), Banco del Pacífico (2016), Banco Guayaq uil (2016) and Banco Pichincha (2016)

In the 4 banks analyzed, the common interest groups are the collaborators, shareholders, suppliers and customers. Likewise, we observe the importance that the Banco de Guayaquil lends to financial inclusion, as it identifies non-banking correspondents as an interest group. Finally, it is evident that there is no generic list of interest groups in the financial institutions studied even though they correspond to the same sector.

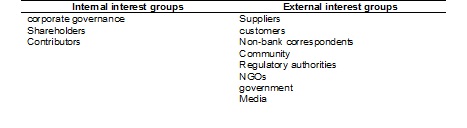

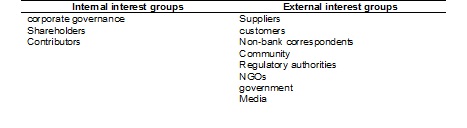

The interest groups related to the financial institutions analyzed are divided into internal and external, they can, in some way, influence or be influenced by the objectives of the organization in different degrees, to the extent that they have between one and three basic attributes: power, legitimacy and urgency. (Mitchell, Agle, & Wood, 1997). The groups of interest are presented in Table No. 10.

Table N ° 10. Internal and external interest groups in the Ecuadorian banking sector

Source: Own Elaboration, based on Produbanco (2016), Banco del Pacífico (2016),

Banco Guayaquil (2016) and Banco Pichincha (2016)

3.3 Analysis of financial inclusion based on sustainability reports

Sustainability reports are the way organizations document, evaluate and report the results of their management in a given period, about their economic, environmental and social performance related to their stakeholders. Ecuador 's banking system, particularly the 4 banks analyzed, presented these reports based on the guidelines of the Global Reporting Initiative (GRI) version 4. Then the actual work being detailed hoisted with respect to including financial usion in function of the sustainability reports presented in 2016.

3.3.1 Financial Inclusion in Produbanco

The corporate social responsibility report corresponding to the year 2016 of Produbanco was prepared under the standards of the Global Reporting Initiative (GRI) version 4. Although financial inclusion is not presented in a section of the report, it is analyzed in a transversal, and is included in the table of indicators.

Use (Banking): In 2016, Produbanco had 698,669 active clients. To make possible the process of financial inclusion in the entire Ecuadorian territory, by 2016 there were 133,889 active credit cards, 12,323 affiliated stores and 396,000 active debit cards. The billing with credit card in 2016 increased by 14.02% with respect to 2015.

In 2016, credit directed to micro-enterprises represented 0.3% of the total gross loan portfolio, while credit to the corporate sector represented 38.41%. Between 2015 and 2016, the microcredit segment showed a growth of 27.08%, at the end of 2016 a reduction of the past due loan ratio to 2.30% was also achieved. The microcredit in 2016 was mainly directed to the economic activities related to food and groceries; restaurants and fast food; urban taxi clothing and acquisition of computer equipment.

Access: Through digital channels, Produbanco processed 116 million customer transactions in 2016, 13% were carried out at the bank's offices and 87% through virtual channels. At the end of 2016, the bank had 306 ATMs. The Bank has service points in all the provinces of the country, including areas of difficult access and cantons where high poverty rates are recorded.

During 2016, the Bank's presence at the national level increased by 10%, with the opening of three agencies and with the incorporation of 162 establishments to the network of non-bank correspondents called Pagoagil. During this period, 1.2 million transactions related to the delivery of the Human Development Bond and 3.6 million basic service payment transactions were processed.

3.3.2 Financial Inclusion in the Bank of the Pacific

Banco del Pacifico, in the sustainability report includes a section related to financial inclusion. For Banco del Pacifico, financial inclusion is about facilitating access to financial services for segments of the excluded population, through the implementation of specific channels and products.

Use (Banking)

Banco del Pacifico had 1,671,577 customers in 2016, an increase of 27.5% relative to 2015 caused mainly by the increase in retail banking. During 2016, 191,000 savings accounts were opened for the beneficiaries of alimony, a vulnerable segment of the population.

Banco del Pacifico in 2010 launched an account that operates through a debit card, in order to bankize people who are unable to access a savings account, for not having the cash flow or requirements. To open a basic account, you need to make an initial deposit of USD $ 5 and present the ID.

During 2016, the amount of credit directed to the microenterprise was almost nil, most of the placements made by this financial institution are aimed at the commercial sector.

Access: During 2016, 7 new agencies were opened. In addition, 71 ATMs were installed, expanding the network to 570. The Bank in 2016 expanded its coverage nationwide by 39.75% compared to 2015, reaching 10.1 42 service points distributed in all province’s country. Likewise, in 2016, there was an increase in the use of mobile banking by 36% and of Internet banking by 15%, improving the accessibility of customers.

Your Banco Banco Here is a network of non-banking correspondents of Banco del Pacífico, which is made up of cooperatives, pharmacies, supermarkets, stores, cybers and other commercial establishments. In this network you can charge basic services. The network allows the Bank to have coverage in sectors of the country where it did not have a presence, increasing bank penetration at the national level.

3.3.3 Financial Inclusion in the Guayaquil Bank

The 2016 sustainability report of the Banco de Guayaquil was made in accordance with the Global Reporting Initiatives version 4. The banking institution, with regard to social responsibility, has a Sustainability Model organized into 4 axes: responsible finance, ethics and transparency, environmental and social.

In the responsible finance segment, the financial institution reports on issues related to financial education, financial inclusion, strategic alliances and training for MSMEs. According to the 2016 report, the Bank contributed to the SDG8, through the delivery of credits to SMEs and large companies, to promote economic growth, inclusive and sustainable.

Use (bancarization): To promote banking and financial inclusion, Banco de Guayaquil has the Cuenta Amiga product. It is a basic account that opens with the single presentation of the identity card, allowing deposits of money and transactions. Since its launch in 2011, 750,000 accounts have been opened, in addition, a debit card is associated with this product.

In 2016, the microcredit segment represented 3 %, while the commercial segment had a 49% share of the bank's total portfolio. As of December 31, 2016, the amount granted as microcredits amounted to USD $ 58 million, while in 2015 it was $ USD 83 million. The share of the credit granted to SMEs was also affected, by reducing their participation 17.13% in 2015 to 10.02% in 2016. The above figures demonstrate the high risk that it represents for the financial institution to grant credit to MSMEs. In these circumstances, the microcredit can be even more affected when the regulatory authority reduces the interest rate for this sector.

Access: Banco del Barrio corresponds to a network of non-banking correspondents (CNB) of Banco de Guayaquil. The financial institution in 2016 had 4,910 service points in 218 of the 221 cantons of Ecuador, representing 99% national banking coverage. The transactions carried out, mainly, were withdrawals, deposits, payment of services, payment of the human development bonus, cellular recharges, remittances and collections of companies.

In 2016, the channels most used by the bank's customers were ATMs with 31.36%, Virtual and electronic banking with 26.93% and neighborhood banks with 21.51%; and this regard, verified the importance that the financial institution to people who do not live in major cities, to have access to financial products and services.

3.3.4 Financial Inclusion in Banco Pichincha

Banco Pichincha is the largest in Ecuador, the eleventh Sustainability Report for 2016, and is aligned with the methodology of the Global Reporting Initiative, version four. This report reports social, economic and environmental indicators that correspond to the management carried out by the financial entity. The topics covered in the report are divided into three areas: 1) Ethics, transparency and human rights, 2) responsible finance and 3) safety, health and environment. Financial inclusion is analyzed in responsible finance.

Use (Banking): Banco Pichincha had 3,068,645 customers nationwide in 2016, representing an increase of 0.6% with respect to 2015. During 2016, approximately 60,000 programmed savings accounts were opened, and 116,000 were managed. microinsurance in the branches of life, hospital care, multi-risk and oncology, 20% more than in 2015. To serve vulnerable groups new products were designed or existing ones were modified, for example, credits for reactivation by the 2016 earthquake, refinancing and restructuring credits and credits for women entrepreneurs or microentrepreneurs.

For Banco Pichincha, in 2016, microcredit represented 11.2%, while commercial credit accounted for 43.8% of its total portfolio. This year it became the first Ecuadorian financial institution to obtain The Smart Campaing 2.0 client protection certification for the microfinance segment. Banco Pichincha during 2016 measured for the second time and voluntarily its sustainability management through the sustainability index Dow Jones Sustainability Index, which is the best-known reference at international level, obtaining an improvement of 16 points compared to the first measurement made in 2013.

Individual Microfinance of Banco Pichincha focuses on the attention of its clients in their own workplaces. During 2016, individual microcredits were offered in 100% of the provinces, 82.78% of the parishes and in 100% of the cantons.

Group Microfinance focuses on forming group boxes with associated people who live in or have similar businesses, who know each other, and can be jointly and severally guaranteed. During 2016, Grupo Microfinanzas served 16 of the 17 provinces on the poverty index. Likewise, of the 11 provinces with low population density, group microfinance was present in 9.

Access: Pichincha Mi Vecino is a network of services made up of microentrepreneurs and small businesses that, with the technology offered by the bank, provide financial and non-financial solutions to the community. Banco Pichincha in 2016 had 11,552 service channels nationwide, of which 10,110 corresponded to non-banking correspondents (CNB) My neighbor, 1,174 to electronic channels and 268 agencies and physical points. During this year there was a decrease in CNB, going from 14,113 in 2015 to 10.110, due to the optimization of attention areas. In this same period, the physical channels were reduced from 291 to 268. During 2016, CNB coverage at the national level represented 100% of the provinces, 58.97% of the parishes and 97.27% of the cantons.

CONCLUSION

Financial inclusion is a part of the social responsibility of financial institutions that consists of promoting access to the poorest and most vulnerable segments of the population to useful financial products and services that meet their needs in a responsible, sustainable and profitable manner.

The analyzed financial institutions present an instrumentalist approach to CSR, since their economic objective is to maximize value for shareholders and use financial inclusion as a differentiation strategy to achieve competitive advantages.

The main guidelines to which the Ecuadorian banking institutions adhere are the Global Compact and the Sustainable Development Goals, while the most used responsible management indicators are the Global Reporting Initiative (GRI), ISO 26000, Dow Jones Sustainability Index (DJSI) and the Smart Campaing.

In Ecuador, the regulatory environment related to financial inclusion has been shaped by the current Constitution since 2008, as well as through the approval of laws, regulations and resolutions related to microfinance, use and access to products and services. financial services, means of payment and with the reduction of barriers that block financial inclusion.

In the banking institutions studied there is no generic list of interest groups despite belonging to the same sector. In order to be considered as interest groups they must influence or be influenced to some degree by the objectives of the banking entities, insofar as they possess power, legitimacy and urgency.

In the four financial institutions, inclusion was analyzed based on sustainability reports for 2016, taking into account the use and accessibility dimensions of the multidimensional index of financial inclusion (MIFI), as well as microcredit. During this period there is evidence of an improvement in the use and accessibility of financial products and services.

During 2016, the microcredit granted in three of the largest banking institutions in Ecuador represented less than 5% of the loan portfolio. On the other hand, during this same period, credit to the commercial segment had the highest participation. The situation in Ecuador characterizes the majority of developing countries, where formal banking still does not massively serve clients in the microfinance segment.

REFERENCES

Please refer to articles in Spanish Bibliography.

BIBLIOGRAPHCIAL ABSTRACT

Please refer to articles Spanish Biographical abstract.