______________________________________________________________________________________________________________________________________________

Visión de futuro

REVISTA CIENTIFICA

ISSN 1668 - 8708 VERSION EN LINEA

URL DE LA REVISTA: http://visiondefuturo.fce.unam.edu.ar/index.php/visiondefuturo/index

E-mail: revistacientifica@fce.unam.edu.ar

_____________________________________________________________________________________________________________________________________________

AÑO 17, VOLUMEN 24 N° 1, ENERO - JUNIO 2020

URL DEL DOCUMENTO: http://visiondefuturo.fce.unam.edu.ar/index.php/visiondefuturo/issue/view/17

Los trabajos publicados en esta revista están bajo la licencia Creative Commons Atribución-NoComercial 2.5 Argentina

MICROFINANCE IN ARGENTINA: A SISTEMATIC LITERATURA REVIEW

Sofía Orazi; Lisana Belén Martínez; Hernán Pedro Vigier

_________________________________________________________________________________________________________________________________________________

Microfinance in Argentina: A sistematic literatura review

(*)Sofía Orazi; (**)Lisana Belén Martínez; (***)Hernán Pedro Vigier

(*)Instituto de Investigaciones Económicas y Sociales del Sur

Universidad Nacional del Sur

Departamento de Economía

Bahía Blanca, Buenos Aires, Argentina

sofiaorazi@iiess-conicet.gob.ar

(**)Instituto de Investigaciones Económicas y Sociales del Sur

Departamento de Economía

Universidad Nacional del Sur

Universidad Provincial del Sudoeste

Bahía Blanca, Buenos Aires, Argentina

lbmartinez@iiess-conicet.gob.ar

(***)Comisión de Investigaciones Científicas de la

Provincia de Buenos Aires

Universidad Provincial del Sudoeste

Universidad Nacional del Sur

Bahía Blanca, Buenos Aires, Argentina

hvigier@upso.edu.ar

Reception Date: 02/26/2019 – Approval Date: 06/03/2019

ABSTRACT

Microfinance is a set of services specially designed to meet the demands of the population with less economic resources. The most important aim is focused on improving the quality of life of people and increasing their income and investment in education and health. As area of study, a remarkable increase can be identified from the beginning of the twenty-fist century, gaining importance over the years given that microfinance has achieved the recognition of international organizations in the fight against poverty. The present work carried out a Systematic Literature Review on microfinance, analyzing the volume of publication and the main countries and journals that address the subject of study, in Scopus and SciELO databases.

At the same time, we detected the books available for consultation in different national libraries that refer to microfinance in Argentina. Finally, we summarized those works that focus on the economic situation of Argentine microfinance market and which are published in these databases. The aim was to identify the main characteristics of this market, its state of development and to obtain an overview of the possible obstacles it faces to expand in a sustainable manner. In addition, we sought to explore the key gaps in the literature and provide some suggestions for future research.

KEYWORDS: Microfinance; Argentina; Systematic Literature Review.

INTRODUCTION

Microfinance is a set of financial tools, including microcredits, micro-insurance, technical and legal advice, training and project monitoring, among others (Grandes, 2014; Giardili, 2012; Bekerman, 2008; Delfiner et al., 2007). These financial services present specific characteristics that distinguish them from the traditional services. The fact that the allocation criteria are intensive in personal information, and do not consider exclusively tangible guarantees, is perhaps the most outstanding characteristic, common to all Microfinance Institutions (MFIs). Likewise, there is often a great need for follow-up and advice on the entrepreneurial projects, implying a greater work of the advisors, demands that put pressure on operating costs (Impulso Argentino, 2015; Delfiner et al., 2007).

In this context, microcredits are the most widespread and practiced service. Although there is no definition of microcredits that covers all its nuances, in Argentina, Law 26.117 (2006) defines them as credits of reduced amount, less than 120 thousand pesos, to start or expand a micro-enterprise, aimed at the low-income population, in order to encourage self-employment.

Since its foundation in the 70s, with the initiative of Muhammad Yunus, microfinance has aroused growing interest globally. Although it is an incipient area of study, several works attempted to know the structure and size of the market and the impact on the life of the beneficiaries. It has been shown that access and use of quality microfinance services improves the ability to manage risks, smooth consumption over time and increase income and quality of life (Thorsten, 2015; Morduch, 1999).

Some authors argue that these tools were created with the intention of generating social change, providing the population excluded of the formal financial market with various credit and savings services, encouraging the creation and expansion of social economy ventures (Impulso Argentino, 2015; Bekerman, 2004).

These objectives were recognized by international organizations fighting poverty. Such is the case of the United Nations (UN) World Summit, which proclaimed the year 2005 as the International Year of Microcredit, to promote the activity and improve the financing of MFIs around the world (UN, 2005). In turn, a Summit for Sustainable Development was held in 2015, where the member countries approved the new political agenda, committing to the achievement of the Sustainable Development Goals (SDGs) by 2030, among which, in five of the 17 total objectives, the importance of access to financial services is highlighted (SDG, 2015).

According to the United Nations Development Program (UNDP, 2016), the economic growth must reach all people, especially those excluded from the market and the system. To this end, efforts should be focused on the formulation of growth strategies driven by employment, the promotion of financial inclusion, among other fundamental pillars (UNDP 2016). In this way, the promotion of microfinance institutions (MFIs), which boost and accompany self-employment projects, is a key to achieve the inclusion of this population underserved by the formal credit market, and create a path for the development of local enterprises (Martinez et al., 2015).

The greatest increase in these services took place in countries with large population living with less than one dollar per day, such as Bangladesh or India (Banerjee, 2013) and, for this reason, it spread rapidly throughout low-income Latin American countries (Agüero, 2008). In Argentina, the development of the microfinance market is lower than in other countries of the region, such as Bolivia, Colombia or Peru, among others, and it is limited to the microcredit market (Ferreyra, 2014; Grandes, 2014; Delfiner et al., 2007; Bekerman et al., 2006).

The recognition of the importance of the microfinance market in Argentina aroused from the Law on the Promotion of Microcredit for the Development of the Social Economy No. 26,117 passed in 2006. From this law, the National Commission of Microcredit (CONAMI, as per its initials in Spanish) was created in order to regulate and train MFIs, with the support of the Social Capital Fund (FONCAP, as per its initials in Spanish) created previously in 1997, with the main objective of financing microenterprises. Together with the Argentine Network of Microcredit Institutions (RADIM, as per its initials in Spanish), the efforts to carry out the development of microfinance are complemented.

Beyond the commitment of these institutions, it is recognized that there is no unified and complete registry of active MFIs. The lack of information regarding the active institutions, their scope of influence, volume of operation, etc., leads to greater difficulties to plane public policies aimed to strengthen this segment in Argentina.

At the same time, several works, despite using heterogeneous methodologies and definitions of what is considered as a population demanding microcredits, affirm that, in the Argentine urban market, there is a great potential demand that is not being contemplated by the short development of the MFIs, the lack of regulation and financing, and the strong concentration of supply in Greater Buenos Aires (Impulso Argentino, 2015; Grandes, 2014; Bekerman et al., 2006; Curat et al., 2006).

These studies indicate that there is a great potential to develop the microcredit market, but the lack of definitions and continuous estimates over time, and which are not homogeneous in methodology, and outside of what are large cities, hinders the development of the market.

For this reason, we consider it is important to identify the existing literature of the microfinance market in Argentina, in order to know the status of a relatively new market, little visible, although with strong economic and social effects over the low-income population. Once the existing literature linked to the topic of study is compiled, the gaps of it are recognized, that is, those aspects of the market that have not yet been considered by the literature are identified.

Following this line, the present work has a double objective: first, to detect the volume and evolution of the academic works in reference to the international microfinance market, published in the main international databases, such as Scopus and SciELO. Second, the study is extended by analyzing the existing literature for Argentina. For this purpose, two parallel searches are carried out. On the one hand, the previous search is filtered, incorporating the keyword Argentina in Scopus and SciELO and, in turn, the digital catalog of the main National Libraries is analyzed in order to identify the books that contribute to the study area and that can be consulted in these libraries. Finally, we summarize the research studies published in journals indexed in Scopus and SciELO, whose object of analysis is the Argentine microfinance market or the experience of the impact of the various local microfinance programs.

The structure of the present work is the following. Section 2 shows the development of the work including the methodology, the search process and the results obtained. Finally, section 3 presents the conclusions of the work.

DEVELOPMENT

Methodology

The process of systematizing the available information of a certain area could be carried out by different strategies. One of them is the Systematic Literature Review (SLR); a method that stands out for identifying, evaluating and synthesizing exhaustively all relevant studies on a given topic.

In addition, a qualitative type of review could be carried out. The narrative review is a process of synthesis of primary studies and exploration of heterogeneity in a descriptive way, instead of statistics. It seeks to identify points in common and differences between the studies in order to inspect each of them considering the applied study methodologies, populations and results found in each case (Petticrew and Roberts, 2006).

Following the bibliometric study of Tranfield et al. (2003), there are three steps usually followed. The first step is to detail the general and specific objectives of the investigation. To establish these objectives, it is recommended to take into consideration the population to be analyzed, the intervention, the context, the results and the users of the review. From there, the search criteria and the selection of the databases are established. The selection of the inclusion/exclusion criteria must respond to the objectives and hypothesis proposed, and also to the interests of the research and of the final users of the work, as well as to the pertinent theoretical considerations. These criteria should be clear and consistent throughout the course of the investigation to avoid biases in the final results.

The second step of execution analyzes the search and exploration of articles, authors, years of publication, journals, among other metrics on the area of interest. In this step of execution, it is necessary to consider that not all the information pertinent to a specific area is published in indexed journals. There is also what is known as gray literature (or fugitive), referring to the research carried out by organizations, academic and non-academic ones, such as books, theses, reports, notes, congress articles, etc. In this way, although it is necessary to recognize that research studies published in scientific journals have been subjected to a blind review process of editors and peers, which guarantees rigor in the method and results, there is also literature with important contributions to the area of study, which are not published in these means of dissemination and whose availability may be more limited. Consequently, no review will be completely full.

Finally, in the third stage, the synthesis and the analysis of the results are presented.

Particularly, in the present work, the first step is based on identifying the main articles related to microfinance at a global, regional and national level. The search criteria consider a set of keywords, such as: Microfinance, Microcredit, Microloan, Microlending, in English and then in Spanish: Microfinanzas and microcrédito. These words encompass the articles of the area, responding to the terms more frequently used in the literature and according to other existing reviews (O’Malley and Burke, 2017; Chen et al., 2017). It should be noted that all the articles published in Spanish also have the abstract and the keywords in English. That is why the search was conducted in English, given that there are no additional works only in Spanish.

Two large databases were used, the first of them called Scopus, considered one of the largest scientific bases in the world, in terms of publications in international journals. The other one, known as SciELO, includes publications of great value for the academic development of the Latin American region.

In order to identify part of the literature which is not present in the academic articles published in indexed journals, a search was conducted in the digital catalogs of the main National Libraries. In the first place, the National Library (Mariano Moreno) was consulted and then the Libraries of the ten Universities with the highest academic reputation and international contributions, according to the Quacquarelli Symonds consultancy index . The search was performed with the same keywords mentioned above, although in this case the vast majority of the results were found in Spanish.

The libraries consulted were: the National Library of the Faculty of Economic Sciences of the University of Buenos Aires; the Library of the Torcuato Di Tella University; Library of Economic Sciences of the National University of La Plata; Library of Economic Sciences of the National University of Córdoba; Library of the Austral University; Library of the University of San Andrés; Central Library of the Argentine Catholic University; Library of the National University of Rosario; Library of the University of Belgrano; Library of the National University of the South; and the Library of the Faculty of Economic Sciences of the National University of Misiones.

While it is recognized that these books are an important contribution to the area of study, there is great difficulty in accessing to their content, so they are not included in the last stage of the narrative review.

After the searches and the collection of all the most relevant bibliography, the information is synthesized focusing on the study of the publications of indexed journals that discuss microfinance in Argentina. Being a small number of publications, progress was made in the construction of a classification of the papers and, finally, of a synthesis of those works with a market or impact approach. This methodology moves away from what is a SLR, and resembles more a narrative review (Norton et al., 2016; Wong et al., 2013; Petticrew and Roberts, 2008).

The narrative review is less structured than the previously presented methodology since it responds more flexibly to the needs of the research. The degree of depth in the explanatory tables will depend, ultimately, on the research question and the heterogeneity that may be found among the articles analyzed. In social sciences, it is common to find great heterogeneity in populations and methods, and it is even greater among those studies that use qualitative techniques, which leads to a bigger challenge when presenting and synthesizing information (Petticrew and Roberts, 2008).

Search process

The search process for scientific papers was done with the keywords mentioned above, in the title, abstract or within the set of keywords, without filters of years or types of document, during June 2018. Then it was checked that there were no additions with the words in Spanish. Chart No. 1 summarizes the stages of the process.

As can be seen, the first systematic literature review (SLR 1) shows a total of 4121 documents from the general search in Scopus, and 100 additional documents in SciELO, of which 20 articles were discarded because they were published in both databases. After analyzing the main metrics of these documents, a second systematic review (SLR 2) was carried out by introducing a filter by country to obtain the documents specifically devoted to analyzing the microcredit market in Argentina.

With this filter by country and by keyword Argentina, 23 articles were obtained in total between both bases and two documents were discarded at once, given that they did not present a specific analysis of microfinance despite including the terminology required within the abstract or the keywords. After examining in detail the 21 articles, a classification was conducted between political/historical, anthropological, ethnographic, and market or impact articles. Continuing with the specific objective to know in detail the state of microfinance in Argentina, a narrative summary of the 13 market or impact articles was made.

Chart No.1. Search process

Source: Own Elaboration

In the next section, the main metrics of the documents found in the first search process (Scopus and SciELO) are analyzed considering the total number of years, languages and types of documents. Next, the second review focused on Argentina and the narrative synthesis of the works directed to the Argentine microfinance market is presented.

Publications in microfinance

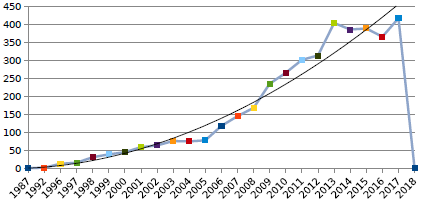

As can be seen in Graph No.1, there is a growing interest in the area of study of microfinance.

From 1987 to the present, a total of 4201 documents were published. In particular, since the beginning of the 21st century, there has been an increasing volume of publications in the area, which could be explained by the growing influence of international organizations and national governments, in the promotion and financing of policies to solve financial exclusion. As is the case of the United Nations, which declared the year of microcredit in 2005, in addition to the recent Sustainable Development Goals (SDG, 2016), or the report of the United Nations Program (UNDP, 2016), as developed in the introduction of work.

Graph No.1. Total articles per year

Source: Own elaboration considering Scopus and SciELO databases

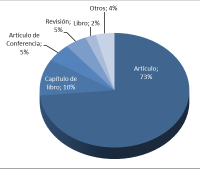

The vast majority of these documents are academic articles (73%), as can be seen in Graph No.2.

At the same time, chapters of books (11%), conference articles (5%), reviews (5%), books (2%), among others, were also found.

Graph No.2. Total documents by type

Source: Own elaboration considering Scopus and SciELO databases

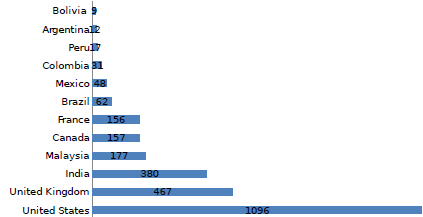

Regarding the location of the publications of these studies, as can be seen in Graph N. 3, the main six international countries, and the main six countries of Latin America that publish the subject of study are shown.

At an international level, the United States and the United Kingdom are the first countries with more publications in the area.

On the other hand, 119 documents published in Latin America were detected, with with Brazil topping the list, Mexico and Colombia with more than 30 published documents, followed by Peru, Argentina and Bolivia.

Graph No.3. Total articles by country

Source: Own elaboration considering Scopus and SciELO databases

As a conclusion to this section, it can be noted that, at the international level, microfinance has developed a vast and varied field of analysis, although it is still an incipient area with great growth from the year 2000. It can also be highlighted that the Academic articles are the most abundant in these bases, and books are represented by a small percentage of the total results. On the other hand, even though it is a phenomenon that has spread among underdeveloped countries, developed ones publish most of the works devoted to the subject. Within the countries of Latin America, Argentina is one of the countries that has contributed the least to these international bases.

Microfinance publications in Argentina

In this section, a detailed analysis of the works published for the Argentine microfinance market is carried out. For this, the second systematic review was conducted, where a total of 23 articles were found in both Scopus and SciELO databases, and a total of 29 books were identified from the National Library and the libraries of the ten most prestigious Argentine universities.

Table 1 shows in chronological order the books that consider the Argentine microfinance market, being relevant for the study area.

It highlights, for each book, the libraries in which they can be consulted.

Table No.1. Microfinance or Microcredit Books in Argentina and their availability in National Libraries

Source: Own Elaboration

It can be seen that the academic development of microfinance in Argentina has also had an increase in publications since 2003 and 2004, but unlike the international context, from 2011 or 2012, the interest in this field of study has declined. In addition, in comparison with the quantity of academic articles, a great diversity of books has been found, unlike what was identified for the international review, in which the vast majority of the results in the bases were academic articles. As for the authors of the aforementioned books, it can be seen that Bekerman, Grandes and Tapella also published academic articles on the journals inside the databases consulted. At the same time, during these years there was an international interest to know and analyze microfinance markets in the region. Studies were funded in Argentina by organizations such as the United Nations Development Program, the Inter-American Development Bank or the Economic Commission for Latin America and the Caribbean.

However, due to the lack of availability in numerous cases and the absence of the peer review process, such as publications in indexed scientific journals, they are not included in the narrative review developed in the following section.

Narrative synthesis of the publications on microfinance in Argentina

Within the results obtained in the searches of Scopus and SciELO with the keywords including Argentina, there were two excluded works: first, the work of Guercio et al. (2015) that, although its keywords contain the word microcredit, this study is about the financing of small and medium enterprises, which use financial services on a larger scale, so it is beyond the scope of the analysis of microfinance. Second, the work of Friedrich (2014) contains the word microlending, making reference to the discourse, between democratic and neoliberal, that adopted a program of education for the poor population, that was developed in Argentina following the line of international work of the Teaching for all project, from the United Kingdom, but which is not related to the finance field.

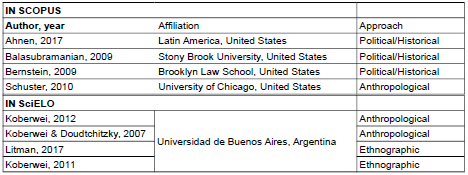

The remaining 21 works were divided into three major groups according to their approach: political/historical, anthropological/ethnographic or market/impact of microfinance in Argentina. Table No.2 presents the works of Scopus and SciELO, which were identified with political/historical or anthropological/ethnographic approaches.

Table No.2. Political/Historical, Anthropological and Ethnographic Articles

Source: Own elaboration considering Scopus and SciELO databases

Within the studies of the first group of works that are in Scopus, with a political and historical vision, Ahnen (2017), Bernstein (2009) and Balasubramanian (2009) refer to the social effects of public microcredit programs, and whose objective is to present certain reflections on the history and politics of Argentine institutions, using pre-existing reports and stories or journalistic notes. Moreover, the work of Schuster (2010) analyzes the case of the NGO Warmi Sayajsunqo, located in Abra Pampa, Province of Jujuy, and seeks to explain the relationship between the administration of the MFI and the objectives of the original community, to re-signify their rights, preserve their culture and generate opportunities to improve their quality of life.

It should be noted that the works that are in Scopus, although they refer to the Argentine microcredit segment, were conducted by US institutions. On the other hand, the works that were published in SciELO, on anthropological and ethnographic aspects, come from the University of Buenos Aires.

Within this second group of articles published in SciELO, there are two works (Koberwei, 2012 and Koberwei and Doudtchitzky, 2007), whose approach is anthropological, and seek to study the social and cultural manifestations that are generated between the groups of beneficiaries and the MFI of study. And finally, within this group, there are the works of Litman (2017) and Koberwei (2011) that have an ethnographic approach, so their object of study is to understand the social relationships that are generated in a microcredit program.

As mentioned above, the objective of this paper is to identify the gaps in the literature on the market or impact aspects of the microcredits, so those works that have this approach are further analyzed.

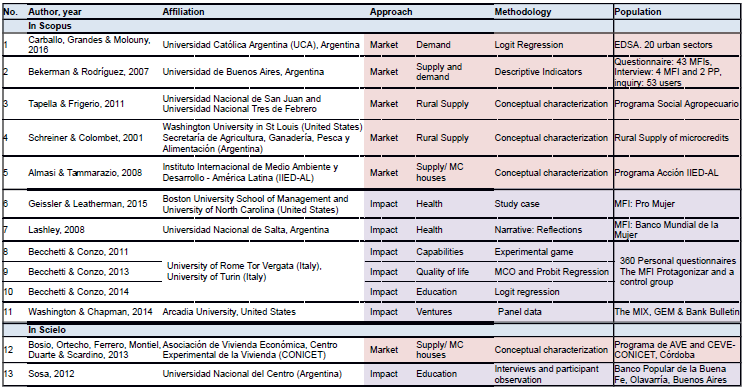

Table No. 3 presents in detail the 13 works with market or impact orientation, classified according to whether they were published in Scopus or SciELO, and are grouped according to their main objective: the first group corresponds to those studies focused on the market, and the other one, to the analysis of the impact of microfinance in different aspects.

In addition, the table details the affiliation, the methodology applied, and the population or database of each article.

Table No.3. Description of the works of market or impact approach for Argentina

Source: Own elaboration considering Scopus and SciELO databases

A remarkable feature of the reviewed articles related to the microfinance market in Argentina is that several local universities (UBA, UN San Juan, UN Tres de Febrero, UCA) have worked on the determinants of the market, supply and demand, seeking to know what population would demand microcredits, the difficulties faced by the supply, either through Microfinance Institutions (MFIs) or through Public Programs (PP). On the other hand, international institutions, in collaboration with local actors, are more interested in studying the impact of microcredits on the quality of life of the participants. These collaborative works come from Universities and Institutes in the United States and Italy.

A recent work by Carballo, Grandes and Molouny (2016) is the only one that analyzes the market from the demand side. Its objective is to know the determinants of potential demand, that is, what socio-economic characteristics are determinant for a person to manifest a predisposition to obtain a micro-loan. They use the Survey of the Argentine Social Debt (EDSA, as per its initials in Spanish) carried out by the Argentine Catholic University (UCA, as per its initials in Spanish) in 20 urban sectors. A Logit or binary regression is conducted, verifying that the type of employment, informality, age, marital status and recidivism in indebtedness are determining factors in the probability of requesting a microcredit.

On the other hand, Bekerman and Rodríguez (2007), based on the objective of knowing the situation of the supply, perform various academic activities in the field work. They conduct surveys on 46 MFIs, and in-depth interviews to 4 MFIs, and also two public programs (PP) for the promotion of microcredit. In addition, they test the results of these programs from the user's point of view, so they conducted a survey on 56 beneficiaries and a non-beneficiary control group. The analysis of these data is descriptive. They emphasize that the market has an incipient development, with various obstacles and marked differences in terms of management and financial results between large and small MFIs, and between public and private institutions. Regarding the perspective of the user, they highlight that there are improvements, especially economic ones, in income and quality of housing, derived from investment in ventures. Moreover, they observe an enhancement in the future perspective and self-esteem.

The studies mentioned above focus on institutions that work in urban areas, unlike the work of Tapella and Frigerio (2011) and Schreiner and Colombet (2001), which are aimed at the analysis on the provision of microcredit in rural areas. Both papers use the word lessons to summarize the obstacles that have been evidenced in public banks and national programs applied in rural areas. Common aspects to both works are the reference of difficulties found in the provision of rural credits, over wide geographical distances, the lack of diversification of income, the scarce information and trust, which increase the costs and risks of the credit provision of these areas. The work of Tapella and Frigerio (2011) analyzes the Agricultural Social Program, while the work of Schreiner and Colombet (2001) examines the differences between public rural development banks, the success of MFIs in urban areas, and the technical differences between them, resuming international contributions, synthesizing and applying the material determinants and behavior of rurality to rural areas of Argentina.

On the other hand, Almasi and Tammarazio, (2008) and Bosio et al. (2013) analyze the supply of microcredits but, unlike the rest of the works, the credits are for refurbishing houses. Almasi and Tammarazio (2008) carry out a descriptive work in which they explain the experience of the International Institute for Environment and Development of Latin America (IIED-AL) in Buenos Aires. They seek to explore the key points of successes and obstacles in each stage of their development, especially after the last reform, in which the administration of the credits, which were by solidarity groups, had become the responsibility of volunteer inhabitants of the neighborhood. The points in favor of the decentralized system, where there are groups with local administrators, are based on the strengthening of local skills, on making sure that they meet the main demands of the place, and that they contribute to a long-term development, fostering the participation and collaboration of the entire community. The difficulties are mainly due to credits that have not been repaid, which hinders the allocation of future funds for the group. At the same time, the participation of volunteers to manage credits and groups becomes difficult.

Bosio et al. (2013) analyze the effect of microcredits for housing, through an action-research methodology, which consists of three steps: (i) surveying the situation, (ii) providing the service and (iii) gathering the necessary information for the evaluation and adaptation of the system. They describe the experience of a microcredit program in the city of Córdoba, Argentina, promoted by the Economic Housing Association (AVE, as per its initials in Spanish) and the Experimental Center for Economic Housing (CEVE-CONICET, as per its initials in Spanish). This project focuses on assisting families with housing shortages, regarding options and materials. At the same time, low-cost solutions are financed to help improve the quality of life of the low-income population, given that 80% of these demands are concentrated in the population of lower-middle and low incomes (according to the Undersecretariat of Housing of the Nation, for the year 2008), given that this population is excluded from bank loans. As a positive factor, it is highlighted that since its creation, in 1995, until the time of the study (in 2007), the initial fund had rotated almost five times among neighborhood residents, showing a commitment to repayment and dynamism. The difficulties that are observed correspond to the lack of agreements with suppliers of construction materials, who have different prices and qualities by area. In addition, the neighbors indicate the need for legal advice, and a list of specialists with recommendations that can assist the borrowers. The institution notes the difficulty of motivating professionals for technical assistance, and the need for external financial support due to the persistent inflation in material costs.

As a synthesis of the works that analyze the microcredit offer in Argentina, it can be mentioned that, at some point, all the articles presented emphasize that the role of the State should be to strengthen the financing of the institutions that provide microcredits, to improve the ability to cope with costs and risks associated with the target population and to achieve an expansion of the market and a greater social impact in regard to the country's poverty. At the same time, there is a need to have a register of institutions and debtors, a normative framework that regulates and promotes microcredits, and institutions that encourage the training of microfinance institutions committed to social action in the territory where they operate.

In terms of the works that measure the impact of microfinance on the target population, the contributions of Lashley (2008) and Geissler and Leatherman (2015) are highlighted, which analyze the impact on health, inviting reflection on the benefits of integrating a preventive health care service together with the microcredit. Geissler and Leatherman (2015) carry out a case study in which a general health check is implemented for the clients of the ProMujer Institution, located in Buenos Aires. On the other hand, an article in the Bulletin of the World Health Organization, by Lashley (2008), describes the experience of the World Bank of Women, an institution that provides microcredits in the province of Salta and Jujuy. This organization entered into an agreement with two medical associations in the region, to cover microcredit clients with basic coverage health insurance.

Both articles agree that the vulnerable population, with which these institutions work, have many unmet health demands, and that efforts in prevention and minimal health care entail a significant improvement in the quality of life of these people. Moreover, it is emphasized that these measures avoid higher health costs in the future, which may have a negative impact on the solidarity guarantee group to which the families belong and on the microcredit institution itself.

The authors Becchetti and Conzo, (2011, 2013 and 2014) conducted three studies based on a field study in 2009, which they carried out together with the MFI Progresar, which grants microcredits in three locations in Greater Buenos Aires. They performed a questionnaire and an experimental game to 150 clients of the institution. In addition, they used a control group of another 150 entrepreneurs from the same place, who met the requirements to receive a microcredit and had not requested it. And finally, a group of 60 people who had left the credit cycle.

Three articles are derived from this study. The first one, published in 2011, analyzes the experimental game to contrast the capabilities, as a set of opportunities or aptitudes that are created from the trust generated among the groups of lenders of an MFI. This paper demonstrates that, in relation to the asymmetric information present in the financial market, the existence of MFIs that grant microcredits, in addition to individually favoring the borrowers and enhancing their ventures, provides necessary information as a sign of a reliable credit agent, which is valuable especially among these people who do not have guarantees.

The second article (Becchetti and Conzo, 2013) analyzes the impact of the provision of microcredits on the quality of life, since people claim to be more satisfied with their lives, and their future economic expectations, self-esteem and social recognition improve. A logit regression is performed in which the dependent variable is ordinal, and reflects the degree of satisfaction in current life, explained by other variables of perception and income. The results show that these subjective factors are determinant of the quality of life and the degree of satisfaction of people, and would be even more important than the improvement in the income due to the microcredit.

The third mentioned article (Becchetti and Conzo, 2014) focuses on the impact on the education of the minors in the family, when a microcredit is granted. The objective is to test this effect against the existence of mixed evidence. On the one hand, a positive effect is identified, which is related to improvements in income, the best capacity to soften consumption and the empowerment of women, who would be more likely to seek their children to study. And, on the other hand, the negative effect on the fact that a venture in the family may require that minors also work and reduce their hours of study. They present a series of Logit regressions, whose dependent variable is binary, which takes value one if the child went to school in the year, and zero if he/she did not. The results found were positive for those areas of lower-middle income, although not for families with lower incomes. In addition, they were positive for remote but productive areas. That is, the extra income that was obtained from the venture after receiving a microcredit would have helped overcome certain low cost barriers, to allow minors to go to school, but did not structurally modify the demand for educational services of the study population.

Sosa (2012) analyzes education in relation to microfinance based on a different orientation than that presented in previous works. Its objective concerns the identification of the meanings of education, the ideologies and preconceptions of solidarity groups, on which they confront with the current meanings of educating in modern capitalism. It focuses on analyzing how the Banco Popular de la Buena Fe (Popular Bank of the Good Faith) emerged and settled in Olavarría, Buenos Aires, by conducting interviews and in-depth field observation. In conclusion, it found certain meanings of education that can be disruptive to the current sense of education, for example, considering the agent as the creator of his own destiny and participant in a larger network than the individual one. Beyond these particular points, there is a critical argument against the provision of microcredits, considering it as a solution that qualifies as a palliative of inequality, and that is generated in a capitalist market economy where the mechanisms of marginalization would remain intact.

Other publications related to the topic of study are Washington and Chapman (2014), who perform an analysis of the effect of the size of the microcredit market, on the number of ventures in the country and, in particular, those carried out by women. They analyze the cases of Argentina, Brazil, Colombia and South Africa between 2000 and 2009. They test the working hypothesis based on the fact that a larger microfinance market, in emerging countries, is positively related to the volume of ventures in the first place, and secondly, it is positively connected, in particular, to women's business activity. Data on the total provision of microcredits was obtained from the Microfinance Information Exchange (MIX). The data on new ventures (between 3 and 42 months), old (more than 42 months) and on the business activity of women and men come from the Global Entrepreneurship Monitor (GEM). Moreover, variables of gross domestic product and the degree of difficulty to formalize a microenterprise were measured (World Bank, "Doing Business"). The treatment of the data is statistically explanatory, through four models (MCO and three of 2-way FE). It is found that the presence of a wider market of microcredits is positively related to the number of new ventures, but in a negative way to older ventures. This could explain that, according to the authors, microfinance would be useful as initial capital but not as working capital or for larger scale investments. Another explanation may be that the need to attend meetings and courses, imposed by some MFIs, becomes counterproductive in the advancement of the venture. On the other hand, it Is possible that the amounts are insufficient on a certain scale. Regarding the second hypothesis, about women productive activities, they found that this positive effect of microfinance on entrepreneurship is linked to women’s ventures, since the variable men's ventures is negatively related to microfinance.

As a conclusion of the microfinance impact studies, it is highlighted that there is evidence that supports a positive impact on the quality of life of Argentine borrowers, in a great variety of issues, although with some exceptions. Regarding the projects that consider improvements in the health of the beneficiaries, it is emphasized that any effort to cover the unmet demands of the low-income population has benefits for the borrowers, their solidarity group and the institution. In any case, it would be important to be able to quantify these deficits to evaluate the efficiency of the different services used. In relation to the effect of microcredits on the education of minors, there does not seem to be a very marked net impact, although it may help overcome certain cost barriers for minors to access an educational institution.

Other effects on quality of life, measured as self-perception, improvements in future economic confidence and valuation as a credit agent, have been validated, at least for the beneficiaries of the MFI Progresar, although it would be important to replicate these studies for other institutions and in different areas of the country.

Finally, as an impact on the level of business activity, it is also necessary to make some caveats since the volume of the microfinance market is not statistically related to a greater number of older ventures, only to younger ones. Therefore, it would be necessary to evaluate if the microcredit programs could be complemented or articulated with other financial borrowers to overcome this obstacle and promote the development of enterprises.

CONCLUSION

The study of microfinance is an area of incipient research, which was gaining relevance over the years, getting strength from the year 2000. Articles have been published in top-level journals, mainly by developed countries and, to a lesser extent, by Latin American countries. In particular, Argentina is one of the countries in the region with the lowest number of articles published in indexed journals, despite showing great interest in the area of study based on the vast variety of books available in the main national libraries of the country.

The development of microfinance in Argentina has certain limitations, which have been studied in some articles published in large databases of indexed journals. Although they are a heterogeneous group of works, some common points could be found, such as the role of the State, which should increase its efforts to promote and finance microfinance institutions (MFIs), unify the information available for active institutions and on clients, debtors and defaulters at the national level. But also the legislation should be modified; since the creation of the Law to promote microcredit, its operation is limited, it imposes excessive demands and administrative requirements, and limits the ability of MFIs to expand their financial activities beyond credit.

From the user's point of view, although the existing studies are limited to large cities or to some institutions only, there is generally a positive impact on the population and their quality of life, although in all cases there are exceptions, which must be considered when planning the scope of the expansion of microcredits.

Finally, there is evidence of a lack of studies aimed at measuring and characterizing the unmet demands of the poor population that could create productive enterprises and improve their quality of life. With the exception of the work of Carballo, Grandes and Molouny (2016), there is no empirical evidence of this situation, and in turn this study should be updated since the survey was conducted in 2011 and also does not consider large urban and rural areas, by focusing only on 20 localities of the country.

In addition, impact studies, such as those carried out by the MFI Progresar, could be applied to many other microfinance institutions in the country, and also to public programs such as the Secretariats of Social Development of each municipality that has a microcredit program.

These two points, the lack of studies that analyze the unmet demand for microcredits outside the large agglomerates, and that evaluate the impact of these programs in the long term, are perhaps the largest gaps in the existing literature on microfinance in the country. These investigations would be very useful for institutions and the programming of public policies to generate greater financial inclusion and promote economic development, especially among the low-income population.

Therefore, we can conclude that the present work is an initial starting point to know the general situation of microfinance and, in particular, of that market in Argentina, in order to know what has been studied and what interesting aspects remain to be investigated.

REFERENCES

Please refer to articles in Spanish Bibliography.

BIBLIOGRAPHCIAL ABSTRACT

Please refer to articles Spanish Biographical abstract.