Esta obra está bajo una Licencia Creative Commons Atribución-NoComercial-SinDerivadas 2.5 Argentina

ADOPTION OF CORPORATE GOVERNANCE PRACTICES OF THE CHILEAN MARKET IN TRIENNIUM 2015 – 2017

Felipe Eduardo Arenas Torres, Roberto Campos Troncoso, Valentín Santander Ramírez

_________________________________________________________________________________________________________________________________________________________________________

Adoption of Corporate Governance practices of the chilean market in triennium 2015 – 2017

Felipe Arenas Torres

Facultad de Economía y Negocios

Universidad de Talca

Talca, Chile

farenas@utalca.cl

Roberto Campos Troncoso

Facultad de Economía y Negocios

Universidad de Talca

Talca, Chile

rcampos@utalca.cl

Valentín Santander Ramírez

Facultad de Economía y Negocios

Universidad de Talca

Talca, Chile

Valentin.santander@utalca.cl

Date of receipt: 03/21/2019 - Date of approval: 05/15/2019

ABSTRACT

The present research describes the degree of adoption of corporate governance practices of 203 Chilean open anonymous corporations during the 2015-2017 triennium, in compliance with the Norm of General Character N°385. The aforementioned practices must be reported annually to the securities market regulator in Chile, called Comisión para el Mercado Financiero (Commission for the Financial Market). The data analysis, within a confidence interval of 95%, was divided into two stages. First, with a descriptive statistical analysis, and secondly, the presentation of the levels of adoption at the market level, categories and principles for the periods 2015, 2016 and 2017. In both stages, it was established that the degree of adoption is low (close to 30%), and that in the three years of study no interest to make significant improvement in the adoption of corporate governance practices has been evidenced by the corporations.

KEYWORDS: Corporate Governance; Degree of adoption; NGC N°385.

INTRODUCTION

After the crisis of mistrust experienced by different Latin-American markets, due to the accounting scandals occurred during the last decade, and which Chile has not remain away from (Moraga & Ropero, 2018), it is perceivable that the concept of corporate governance (CG) has not been internalized completely, by the Chilean open anonymous corporations.

After three years of application, and later abrogation of the Norm of General Character N°341 (NGC N°341) for corporate governance in 2015, the Superintendencia de Valores y Seguros, current Commission for the Financial Market (CFM), observed that the norm did not reach its expectations, because the answers provided by the corporations were too scarce; neither further background was presented, nor different practices were adopted by the entities, as suggested by the regulator (Superintendencia de Valores y Seguros, 2015). As a consequence, in the year 2015, a project to strengthen the standards of corporate governance began, which evolved into the current Norm of General Character N°385 (NGC N°385).

In this respect, the CFM, as regulator of the financial market in Chile, looked forward to overcome two weaknesses of the NGC N°341, when implementing the new norm. One of them was the formal, yet unpractical, compliance of the demands set by the CG current at that time. The second one was the lack of interest of the entities to improve their practices (Superintendencia de Valores y Seguros, 2015). For improving the first weakness, the concept adopted practice was specified in the norm. For the second weakness, it is the investor who should influence the raise of the degree of adoption, directly or indirectly.

In the same line, when considering de degree of acquisition of the CG practices and according to the NGC N°385, research shows that the compliance of the norm of companies which provide stocks, raised up to an average of 31% in 2015 (PwC Chile & ESE Business School Universidad de los Andes, 2016). Furthermore, between 2015 and 2016, the degree of adoption increased a 3%, which represents a marginal improvement to the expectation, after the companies had an extra year to strengthen their corporate governance and social responsibility structures (Arenas & Sánchez, 2017).

There is some research about this topic, which is connected to the academic-professional area. For example, Moraga & Ropero (2018) analyze the correlation between the degree of adoption of NGC N°385 practices and the sales profitability of the most important companies of the Chilean stock market in 2015, concluding that a relationship has not been established, due to the lack of awareness of the norm and implementation of its recommendations.

On their behalf, consultancy firms conduct descriptive analysis; presenting the average degree of adoption reported by the corporations. For example, Iltis presents the degree of adoption for the 2015, 2016 and 2017 period (Iltis Consulting, 2019). In the same line, PwC Chile in collaboration with the University of The Andes (2016) make a status of the boards in Chile, considering the information of the NGC N°385 reported by December 31st 2015, similarly to the manner that A&C Consultores Auditores (A&C Consultores Auditores, 2019) does. These three analysis determine that the degree of adoption is close to a third of the proposal, whereas the adoption to the recommendations is uneven, when comparing categories, principles and practices.

In accordance to this, corporate governance should not be considered as a trendy topic, but as the solution to the crisis of mistrust perceived around companies (Castro & Cano, 2004), especially when there is a generalized lack of awareness of different stakeholders, about the practices suggested by the regulator in this matter (Moraga & Ropero, 2018). In this sense, the purpose of this research consists in describing the degree of adoption of the governance practices in the period 2015-2017, providing an academic perspective that allows the detection of categories and principles with a minor degree of adoption.

DEVELOPMENT

Corporate governance as a mechanism for self-regulation

In order to describe the degree of adoption of the CG practices, it is important first to know its foundations, the evolution of the current normative framework in Chile, and the state of art related to the benefits of adopting corporate governance practices.

In the last years, a proliferation of initiatives that propose to establish guides and specific outlines to allow the application of governance practices has been observed (Superintendencia de Valores y Seguros, 2015). This was stated by 2009, in 2.147 research publications about a good corporate governance, in the ISI Web of Science database; with 79.635 references respectively (Richart-Ramón et al, 2011).

Additionally, there is a consensus regarding deficiencies of the CG playing a relevant role in the origin and development of financial crisis. This, plus the worldwide interconnection of capital markets, make the harmony for an international framework of governance practices to become essential (Fundación Instituto Iberoamericano de Mercado de Valores, 2015), yet incorporating elements of each country where this norm were to be applied.

According to a role of the regulator, it is necessary that the State complies with the role of controlling the market of values, because it is difficult to sustain that markets may solve their own corporate governance issues by themselves. Likewise, it is also complex to state that corporations may be able to self-regulate (Agüero, 2009).

In regards to the concept of CG, this one includes a series of relationships among the board of directives of an company, the board, stockholders and other interested parts (Organización para la Cooperación y el Desarrollo Económico, 2004). This can be understood as a method to establish order in companies, thus ensuring that common interests are represented in the process for making decisions (Ruiz & Steinwascher, 2007).

In relation to the current normative framework in Chile, this one is structured in two parts. The first one corresponds to the law passed by the National Congress, considering the market of values and anonymous corporations. Both laws were passed in 1981; however, the matter has had two remarkable modifications. The law N°19.705 that regulates the public supply to acquire stocks (OPAS), passed in 2000, and the law N°20.382, so called the corporate governance law, that introduces an improvement to the norm that regulates governance inside companies.

The second part of the normative frame considers the creation of the Superintendencia de Valores y Seguros, provided with the Decree-Law N°3.580, of 1980. The Superintendence is the current commission for the Financial Market, and the organism that provides the norms for sharing information about corporate governance practices of open anonymous corporations, according to the NGC N°385, which was passed in 2015, in replace of the NGC N°341.

In relation to the currently valid NGC N°385 in Chile, a characteristic feature is that it is a self-assessment that includes the criteria Accomplish or Explain, which norms the share of information about the CG practices adopted by chilean open anonymous corporations in a voluntary manner, thus motivating transparency of corporations with their different stakeholders.

Regarding to what is considered as adopted practice, the regulator specifies in the norm that:

“the society adopts a determined practice when it can refer to approved policies for it, plus the procedures, mechanisms and necessary systems for its complete implementation and functioning. Otherwise, it should be understood that the practice has not been adopted, even if the intention of the society were to do so.” (Superintendencia de Valores y Seguros, 2015, s/p).

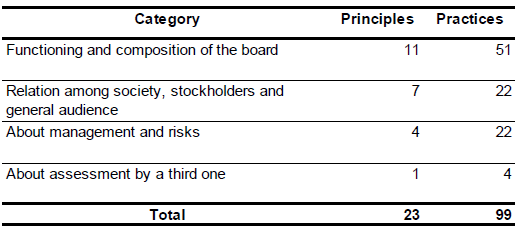

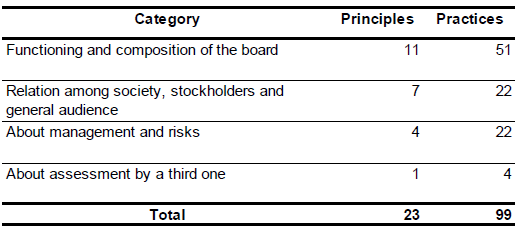

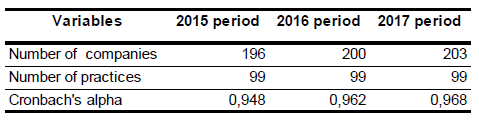

Considering the structure of the NGC N°385, this one is divided in four categories, 23 principles and 99 practices. A vast number of its principles and practices aim at the creation and functioning of the board. Later, at the level of recommendations proposed, we can find the relationship with stockholders, risk management and, lastly, the self-assessment of the board, as evidenced in Table 1.

Table N° 1. Content of NGC N°385

Source: Compiled by authors

In addition, the legislation that regulates CG, Zegers & Consiglio (2013), indicates that it is important for new norms not to be a mere reaction to abuse and real-life scandals. Rivero (2005) adds that such norms should foster the development of better corporate governance practices, in a voluntary manner. In the case that such practices were product of imperative norms, failure would be acknowledged in the system, and the creative and productive potential value of the corporative management would weaken.

Simultaneously, efforts to generate a norm related to this topic should align the principles of the OECD. Therefore, due to the great amount of reports made by the regulated enitities, it would be convenient that efforts focused on defining a unique easy-to-be-consulted document, by whom were interested in CG themes (Briozzo et al, 2018).

Then, it is evident that adopting CG practices influences the corporative performance. In this respect, counting on good corporate governance practices improves the availability and conditions for obtaining resources (Altamirano et al, 2019). Previously, Sanchez and García Meca (2004) studied the CG influence on the profitability of Spanish companies. They concluded that there is a significant influence on the financial profitability of organizations, when adopting corporate governance practices. According to Paul (2017), this allows to prevent fraud or company mismanagement, because as a multidisciplinary guarantee, it pursues the benefit of participants, thus providing transparency, sustainability, supervision and report.

Methodology

The study has a descriptive-longitudinal character because, in the first case, the NCC N°385 results were presented concerning their degree of adoption and, it is longitudinal because the data obtained of the population was obtained in different moments during the 2015 – 2017 period. At the same time, the collection of the data was made using documented and statistical sources (Hueso & Cascant, 2012), specifically through a data bank that belongs to the CFM of Chile.

Each open anonymous society board reports to the CFM the adoption of the NGC N°385, in march of the period after the informed one. The norm is made by 99 recommendations provided by the regulator, which adoption must be reported annually to the organism. The universe of this study was composed by 203 corporations that present reports each year of the triennium of analysis. In this sense, the answers present a dichotomy; either indicating S as a society that fulfills the practice, or N as a society that has not adopted the practice. It is important to highlight that for data analysis effects, S = 1 and N = 0.

Later, a Confidence Interval of 95% was set, according to a Normal Distribution, in order to analyze the data from an academic perspective. Therefore, a population of one hundred ninety six corporations limited to this restriction was set for the year 2015, two hundred for 2016 and two hundred and three for 2017.

In order to obtain this result, the data within the Confidence Interval specified was enclosed, according to what is commonly used in Social Science. First, the procedure consisted in standardizing the data, according to:  , in order to compare effectively the degree of adoption of CG practices acquired by the companies of this study (Anderson, Dennis, & Thomas, 2008).

, in order to compare effectively the degree of adoption of CG practices acquired by the companies of this study (Anderson, Dennis, & Thomas, 2008).

Once standardized, the values obtained, and that will be studied, appear to be distributed normally within a ±1,96 Standard Deviation (standardization of the degree of adoption). Therefore, the de  values studied will be within

values studied will be within  of the mean µ. Being the interval estimation of the population mean µ,

of the mean µ. Being the interval estimation of the population mean µ,  ± with a margin of error

± with a margin of error  .

.

Results

Results are presented in two sections. First, a descriptive statistical analysis about the degree of adoption of the NGC N°385 practices for the 2015 – 2017 period is provided, considering Cronbach's alpha, the mean, the standard deviation and the variation of data. Secondly, the degree of adoption of the research population is presented according to an average level of the reporting corporations; by incorporating a classification by category, principles and practices.

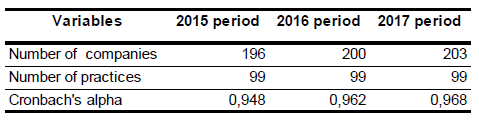

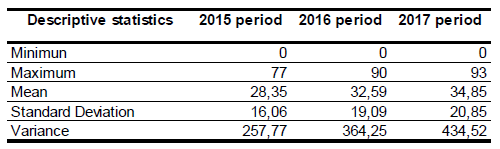

In the first instance, the results of Table 2 show the reliability of the data obtained through Cronbach's alpha, which is over 0,9 in the three periods analyzed. This indicates a strong internal consistency between answers and the recommendations provided by the NGC N°385.

Table N° 2. Statistical reliability of NGC N°385 answers

Source: Compiled by authors

According to Table 3, when analyzing the descriptive statistical elements of each period, we can appreciate that there were corporations that did not adopt practices of the proposed standard. Additionally, the maximum of recommendations adopted within a normal distribution increased 16% during the 2015 – 2017 period, whereas the mean of positive responses for the year 2015 was 28,35%, and 34,85% for the year 2017, thus increasing 6,5%.

About the Standard Deviation and variance, this is 16,06 y 257,77 for the first year of evaluation, increasing to 20,85 y 434,52 respectively, for the 2017 period. This can be understood as the degree of variability that they have, in relation to the adoption of corporate governance practices, in respect with the mean.

Table N° 3. Descriptive statistical positive response to NGC N°385

Source: Compiled by authors

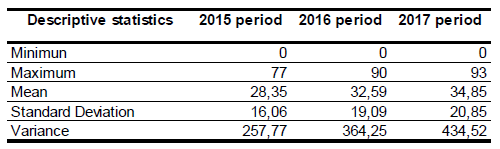

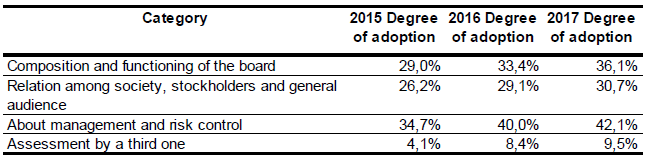

After analyzing the ninety-nine practices for the reporting period 2015-2017 of the NGC N°385, according to Table 4, results indicate that there was a 6,6% increase in the total degree of adoption, having an average of 35,2% for the last reporting year.

Table N° 4. NGC N°385 Comparative results for the 2015-2017 period

Source: Compiled by authors

Regarding the level of progress by categories, results indicate that the area related to the board, in relation to stockholders, a third of them adhere individually to the NGC N°385, whereas in the area of risk control and management, the adoption increases up to 42,1%; being this one the highest. Finally, the category correspondent to Assessment by a third one adheres 9,5% to the standard.

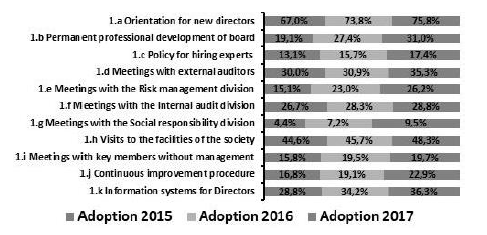

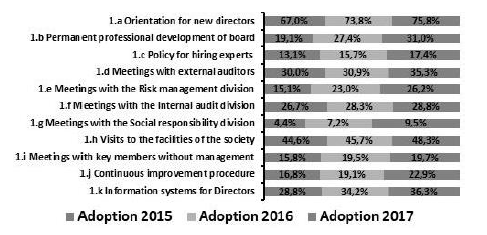

In relation to the principles of each category, results are uneven. For example, in the Composition and functioning of the board, according to Figure 1, the principle that has a greater degree of adherence is related to the orientation of new members; reaching a 76% in contrast to the 10% of adoption of the principle 1.g Meetings with the social responsibility division. It calls the attention that the degree of adoption for the procedures of continuous improvement of corporations is 23%.

Figure N° 1. Degree of adoption for the category Composition and functioning of the board

Source: Compiled by authors

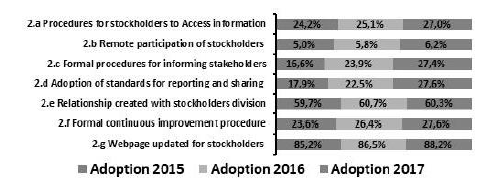

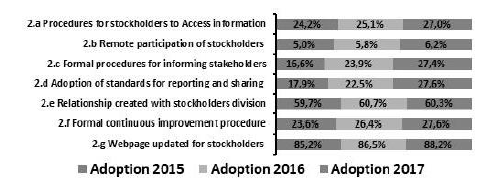

According to Figure 2, 60% of corporations declare having divisions related with stockholders, and 88% has an updated webpage for them. About the principle that has the least degree of adoption in this category, we can find the remote participation of stockholders in General Meetings.

Figure N° 2. Degree of adoption for the category Relationship among the society,

stockholders and general audience

Source: Compiled by authors

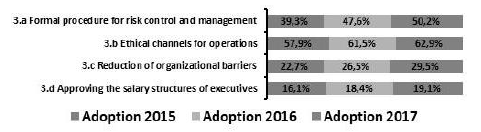

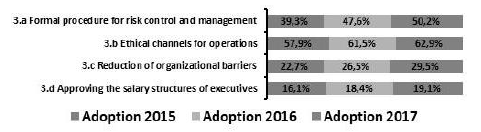

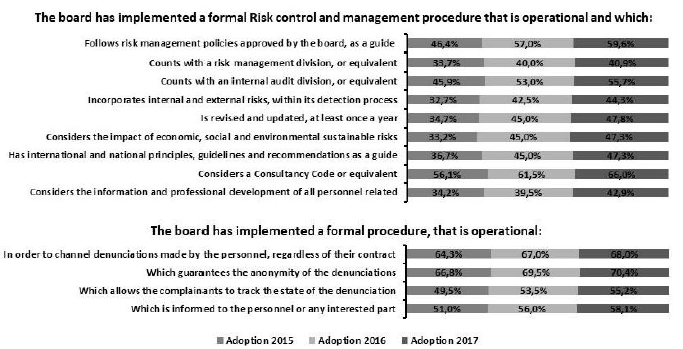

In relationship to the category risk control and management, Figure 3 shows that one of the principles with a greater degree of adoption during the period of analysis is the establishment of ethical channels where members can report any irregularities or infringements, and that these are valid, having a 63% for the year 2017. At the same time, only a 19% of corporations declare having approved procedures for the salary structures of their top executives.

Figure N° 3. Degree of adoption of risk control and management

Source: Compiled by authors

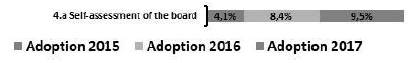

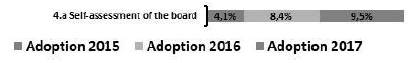

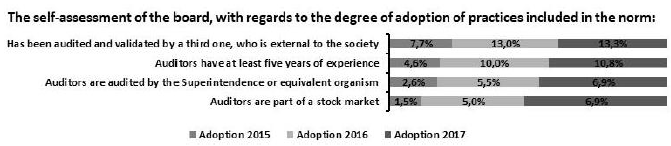

According to Figure 4, one of the principles with the least degree of adoption refers to the practices framed within the board self-assessment; having an adherence of 9, 5% in 2017 and an increase of 5, 4% during the period of analysis.

Figure N° 4. Degree of adoption of assessment made by a third one

Source: Compiled by authors

At the level of practices and similarly to the level of norms, results are uneven and differ, in accordance to the topic addressed by the regulator. Results of the most relevant recommendations will be presented next.

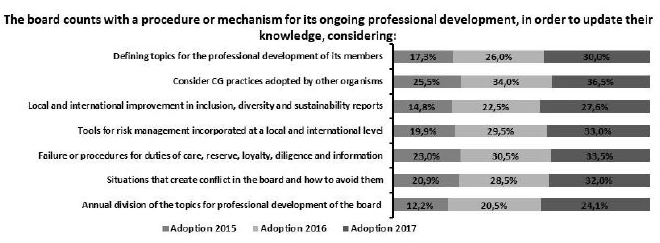

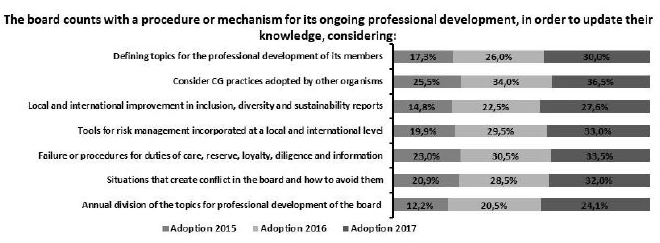

Figure 5 shows the adoption of the practices related to procedures established for ongoing professional development of the board, including aspects related to: CG, inclusion, diversity, sustainability, risk management, and duties and conflict of interests. For example, 36,5% of corporations considered the study of better CG practices adopted by different companies, as part of the professional development of the board in 2017, whereas only 27,6% considers improvement in inclusion, at a local and international level, as part of the procedures of the board.

Figure N° 5. Degree of adoption of practices, principle 1.b

Source: Compiled by authors

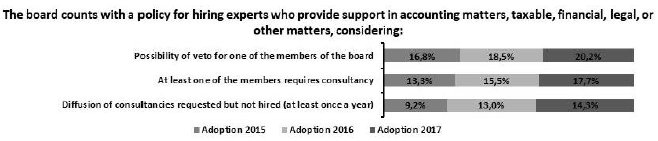

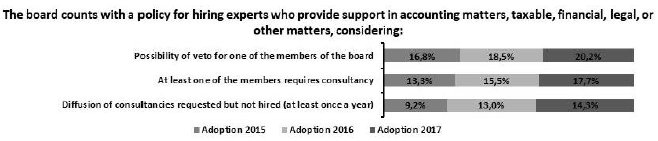

With regards to the policies for hiring experts, Figure 6 shows that there is a marginal increase in the adherence of such practices, and that 17,7% of companies has a policy that considers hiring consultancy, upon the request of a directive member of the board. In relation to the diffusion of consultancies that were requested but not hired, the adoption is 14,3%, being this the principle that increased the most, within the triennium analyzed.

Figure N° 6. Degree of adoption of practices, principle 1.c

Source: Compiled by authors

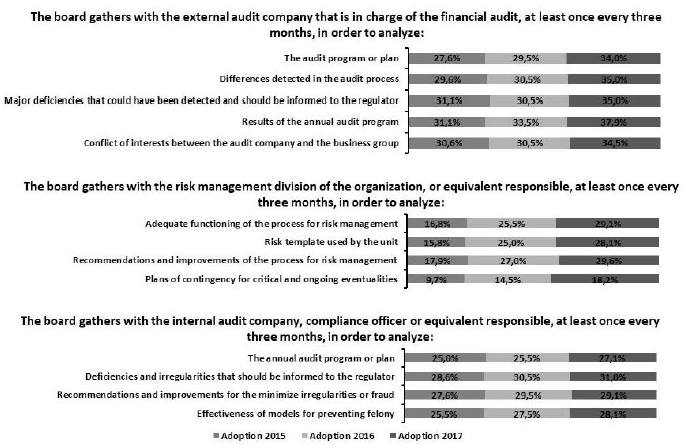

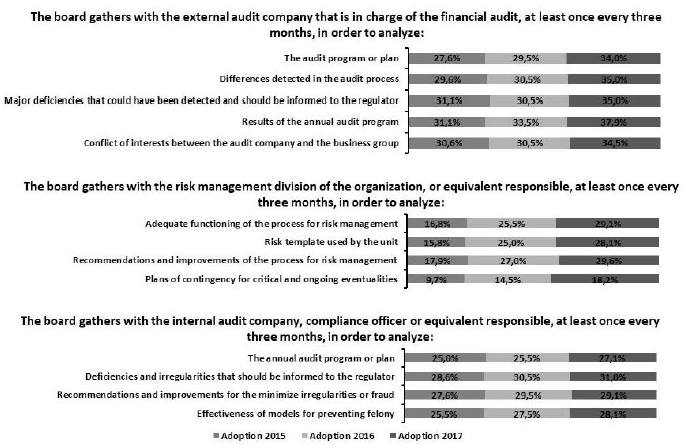

Another group of relevant recommendations refers to the board gathering with the external audit company, the risk management division and the internal audit division, every three months. According to Figure 7, the degree of adherence for external auditor is a 35% in the first instance, where the analysis of the audit planning, differences detected, and results of the audit have quite a homogenous degree of adoption.

In respect with the meetings with the risk management division, results present a lower degree of adherence. For example, 28,1% only of the board checks the risk template used by the unit, and only 18,2% analyzes contingency plans for eventualities that may affect business. For the criteria internal audit division, the adoption is similar. In this sense, only 27,1% of boards is concerned about analyzing the internal audit planning. In order to continue with this analysis, only 28,1% of them analyze the effectiveness of the models implemented by the organization, in order to prevent felony.

Figure N° 7. Degree of adoption of practices, principle 1.d, 1.e and 1.f

Source: Compiled by authors

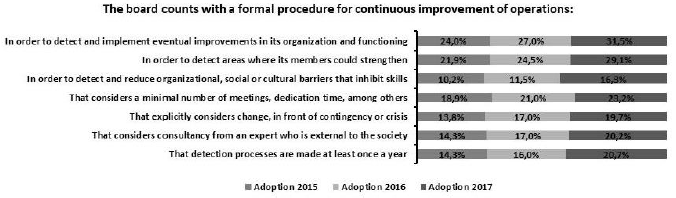

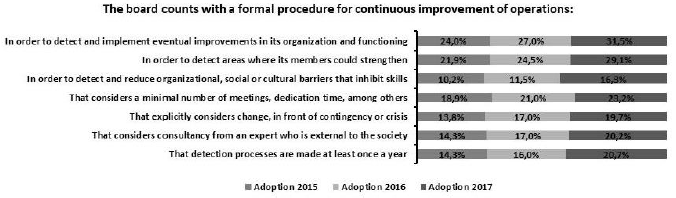

Another important topic attributed to the functioning of the board is related to continuous improvement; area that presents an adherence that fluctuates between 16,3% and 31,5% in 2017. Figure 8 shows that 31, 5% of the companies has formal procedures to detect and implement improvement in the organization. 23,2% has formal procedures for meetings and dedication time of the board, whereas only 20,2% has considered ongoing consultancy, from an expert who is external to the society.

Figure N° 8. Degree of adoption of practices, principle 1.j

Source: Compiled by authors

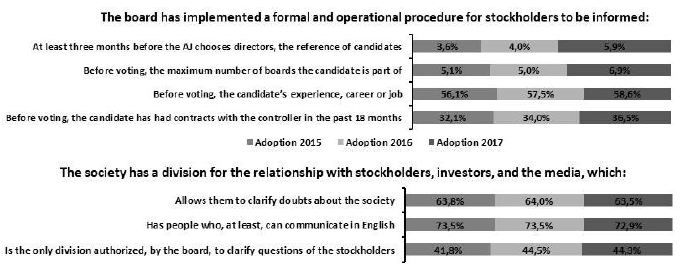

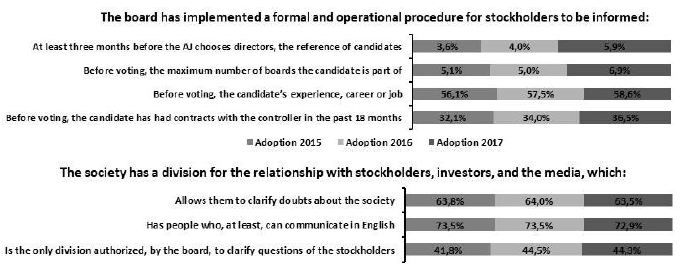

When considering the area related to the stockholders, the results about the implementation of a formal and an operational procedure that informs about several points, Figure 9 indicates that only 5,9% of corporations informs three months in advance, about references of the Director candidate. This contrasts with the 58,6% informed to the stockholders, about the experience, career or job of the candidate.

Another important recommendation is related to the society counting with a division for the relationship with the stockholders. In this regard, 63,5% of them has such division, where stockholders can clarify doubts and ask questions.

Figure N° 9. Degree of adoption of practices, principles 2.a and 2.e

Source: Compiled by authors

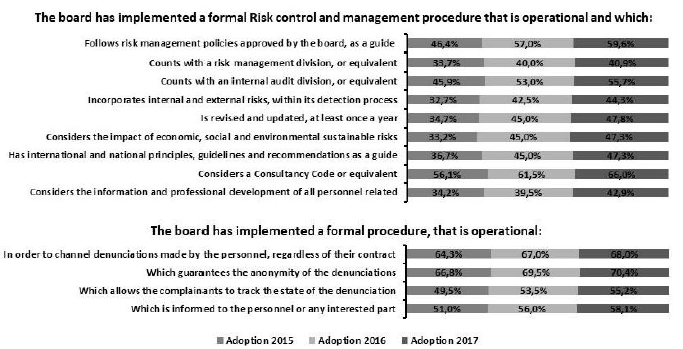

The third category of the norm deals with the risk management area, being this the one with the greatest degree of adoption. For example, according to Figure 10, the adoption of practices related to the implementation of a formal and operational process fluctuate between a 66,0% and 40,9%. It is remarkable to acknowledge the 47,3% of adherence to the orientation, principles and guidelines of risk management, in the operation of the company. Similarly, 55,7% of the corporations have a formalized division of internal audit.

Likewise, Figure 10 addresses an ethical channel, which has a 68% of implementation and operation in companies, thus guaranteeing 70,4% of anonymity of denunciations. Additionally, 55, 2% of the corporations signals that complainants have the possibility to track their denunciations.

Figure N° 10. Degree of adoption of practices, principles 3.a and 3.b

Source: Compiled by authors

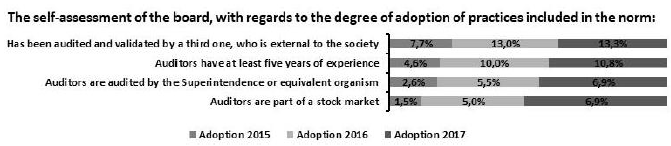

Continuing with this analysis, Figure 11 shows the self-assessment of the board, about the NGC N°385 practices. According to the results, only 13,3% of corporations has submitted self-assessment to the revision of a third one who is external to the society; having only 6,9% of corporations with reviewers audited, or who are signed in a stock market.

Figure N° 11. Degree of adoption of practices, principle 4.a

Source: Compiled by authors

Finally, the results at different levels of study indicate that there is a standstill of the adoption of the NGC N°385. After three years of the implementation of the CG norm, it is not clear whether corporations will increase significantly their adherence to the norm, in the future reports.

Discussion

After illustrating the results of the NGC N°385, there has not been a significant advance in the period 2015-2017 comparatively speaking; neither at its categories nor principles. Therefore, if the objective of the regulator were to strengthen the structure of anonymous Corporations CG, by derogating the NGC N°341 y passing the NGC N°385, the indicator of governance could be declared as weak and incipient.

Among the factors that could explain such situation, we can identify the lack of commitment of the companies to transparency; by considering inconvenient to share such information with the stakeholders (Moraga & Ropero, 2018), and being influenced by the high concentration and existance of controller stockholders (Zegers & Consiglio, 2013).

At the same time, another factor that explains the lack of sharing relevant information for the market could possibly be that this decision obeys to a norm and not to the conviction of the companies (Godoy et al, 2018). The principle Comply or Explain, promoted by the OECD, would allow the investor to decide whether the reasons given by the organization are sufficient and, if not, they should consider the decision of the organization, when making investment decisions (Superintendencia de Valores y Seguros, 2015).

Finally, there are areas where the degree of adoption is concerning. For example, in social responsibility, ongoing professional development, adoption of international standards, approval of salary structures, and board self-assessment, where the adherence is low due to the topics addressed.

CONCLUSION

The study has allowed establishing that, in the three years of implementation of the NGC N°385, the degree of adoption of corporate governance practices is low. Moreover, interest of corporations in implementing a greater number of recommendations is not perceived, due to the low progress in the adoption in the three years analyzed.

In relation to the categories of governance analyzed, we have identified that there is a low interest of the board in implementing practices related to promote information, participation and transparency with the stockholders. Additionally, we can infer that stockholders do not share the recommendation related to self-assessment, which should be conducted by the board, in matters related to their performance in corporate governance, at least once a year.

On the other hand, considering the low degree of adoption of practices for monitoring areas of assurance, such as internal audit, risk management and external audit, it is clear that the supervision role that boards fulfill in Chile is insufficient. Additionally, the lack of formal procedures related to the continuous improvement of the company, and the low adoption of practices related to professional development of the board, allows us to question whether the functions of this Governance Body are in line with the expectations of the different stakeholders of the stock market.

In addition, the low degree of adoption of the NGC N°385 results allows us to evaluate whether the normative principle Comply or Explain, promoted by the OECD for its member countries, could not be the best criteria for countries with economic and cultural characteristics as Chile, or other Latin-American countries.

In regards to the report, this should be revised and audited by a third one who is independent, as in the way that it occurs with the Financial States of corporations. This is because the self-assessment seems more like a checklist where to answer yes or no, rather than a report for the regulator, thus lacking of an audit or certification process that guarantees information with real evidence.

Additionally, there is a lack of audit procedures, by the regulator, that allow confirming the veracity of the information stated by the corporations in their reports. Specially, because one of the objectives of the NGC N°385 is to provide investors with better information to decide investing in the society or not.

Regarding the number of recommendations that the norm establishes, the low adoption could be explained by the CMF not to have incorporated an appendix to suggest practices that corporations should adopt, according to their size. As we can see, companies listing in the New-York exchange are evaluated with the same recommendations that companies having a local economic activity.

Finally, describing and presenting the degree of adoption of the main companies of the Chilean stock-market, within a specific period of time, will allow to start new research related to the effectiveness of the initiatives proposed by the regulator and if the adherence conveys comparative future benefits for the entities, in a period of time.

REFERENCES

Please refer to articles in Spanish Bibliography.

BIBLIOGRAPHCIAL ABSTRACT

Please refer to articles Spanish Biographical abstract.