Techniques and instruments used in this study

Note. Own elaboration.

Internal control in the profitability of a general services company – Peru

(*)Hugo Wiley Escobar Zurita; (**)Libia Magaly Surichaqui Carhuallanqui; (***)Flor Alicia Calvanapón Alva

(*)Facultad de Ciencias Empresariales, Universidad César Vallejo

Lima, Perú

hwescobar@ucvvirtual.edu.pe

(**)Facultad de Ciencias Empresariales, Universidad César Vallejo

Lima, Perú

lsuric@ucvvirtual.edu.pe

(***)Facultad de Ciencias Empresariales, Universidad César Vallejo

Trujillo, Perú

calvanaponfa@ucvvirtual.edu.pe

Reception date: 06/16/2022 – Approval date: 07/11/2022

DOI: https://doi.org/10.36995/j.visiondefuturo.2023.27.01.005.en

ABSTRACT

Nowadays, internal control and profitability are becoming very important to achieve favorable results in the profits of any economic organization. The objective of this research was to describe the effect of internal control on profitability in a general services company Chosica, 2021, for this purpose a quantitative study of the applied type was conducted, with a non-experimental design, cross-sectional and descriptive scope, applying the questionnaire and documentary analysis to analyze each variable. In the results it was found that the level of internal control is at a low level with 62%, the analysis of profitability showed a minimal increase in the ratios of the period 2021, compared to 2020, showing levels of ROA 10%, ROE 19%, ROCE 21% and ROS 10%. thus, reaching the conclusion that internal control has a positive effect on the profitability of the company, so the organization must make a more efficient internal control creating shared values in the collaborators to improve the results in profitability and thus achieve institutional objectives.

KEY WORDS: Internal Control; Internal Control System; Profitability; Profitability Ratios.

INTRODUCTION

Nowadays, internal control is of utmost importance because it is a necessity for every economic organization to assist in the fulfilment of administrative and financial objectives, as well as to ensure an orderly and efficient conduct of its economic activities. Broadly speaking, it encompasses the set of methods, procedures, structure, policies and organizational plan, as well as the skills and virtues of the workers in the company. This will help to protect its assets, help to verify the veracity and accuracy of accounting and administrative information on which decisions can be based (Rodriguez et al., 2020).

Globally it has been shown how deficiencies in internal control in private and public companies can cause errors in administrative and accounting information, which makes it difficult to achieve their goals and objectives of organizations, as noted by Klius et al., (2020) citing Mengmeng, (2017) in studies conducted in different countries indicated that 70% of private companies in bankruptcy in the United States were due to lack of effective control. Consequently, many of these companies are not allowed to compete effectively in the market, as investors are looking for companies that are safe, reliable and able to operate in highly competitive conditions.

At the national level, large, medium and small private companies are in the process of implementing internal control and taking more importance to the risks they are currently facing, such as liquidity diversion, fraud, companies in bankruptcy, others in restructuring and some declared insolvent (Arbieto, 2020). In addition, Peruvian companies confirm that 41 % have been victims of fraud in recent years, often seeing companies investigated for corruption scandals, yet only 6 % accept that they are accused of fraud (PWC, 2020). Moreover, many private companies do not allocate adequate budget for the implementation of internal control, resulting in a poor level of compliance with rules and procdures to achieve the expected objectives (Sanabria, 2021).

In local companies there are currently deficiencies in their internal control, since in many of these companies their administrative management is conducted in an empirical manner, since most of these companies are family businesses, which means that often a family member is in charge of the management. This affects operations in all areas, which does not allow for corrective measures to be taken, in addition to the absence of an organization and functions manual, as those who work in the company are carrying out activities that do not correspond to their functions, leading to a series of non-compliance with policies and internal rules.

The company under study is located in the district of Chosica - Peru, is a company dedicated to providing general services, has more than 15 years in the market with extensive experience, but for some time has been going through some organizational management deficiencies. In this type of company, inadequate internal management of documents and storage of incoming information, ultimately harming the profitability of the company.

As pointed out by Rodríguez et al., (2020) where they say that, when analyzing the control environment component in both sub-processes, the main deficiencies found focus on the fact that there is no definition of the activities. This is due to the lack of control awareness. This is one of the causes of the lack of internal control within the companies, which leads them to commit irregularities, make mistakes and not be able to meet their goals and objectives.

The control that is executed in any way will lead to the success of the company. That is why if the entity does not implement an internal control system will not manage to improve the functions of administrative and accounting processes, as well as the work performed by employees within the company this with the purpose of improving the shortcomings, therefore, the use of internal control is of utmost importance as it provides reliable information and really backed in compliance with policies, ensuring economic profitability (Munirovich et al., 2018).

In compliance with the Sustainable Development Goals (SDG), proposed by the United Nations, this work is related to SDG 8, which refers to promoting inclusive and sustainable economic growth, employment and decent work for all.

In view of the above, the following research problem was posed: What is the effect of internal control on profitability in a general services company, Chosica, 2021?

In this sense, the research has as theoretical justification the criteria proposed by Hernández-Sampieri and Mendoza (2018), since it will allow to have a better management of the resources that the company has, which will determine more accurately its costs and this will allow a better control of the income, providing more reasonable information to improve profitability; for convenience since this study will contribute to the improvement of administrative, accounting and economic processes that support reliable and timely information, in order to improve profitability and internal control; for its social relevance as it will allow to identify the problems of internal control and profitability, with the purpose of improving policies and procedures in all areas of work and strengthen the functioning of the company through efficient management through timely and effective communication and this will contribute to profitability; it was also justified by its methodological usefulness, because the results of this research will be of help for further research studies of a similar nature.

The objective is to describe the effect of internal control on profitability in a general services company in Chosica, 2021.

DEVELOPMENT

Research Background

In order to study the variables in more detail on international and national contributions, indexed scientific articles were examined, as well as in the different repositories of the licensed universities, where the importance of studying the variables of internal control and profitability was found, given that the higher the level of compliance with internal control, the greater the reliability and profitability of the companies.

At the international level, in a quantitative scientific research article conducted in Malaysia on the effectiveness of internal control through a survey of cooperative executives, focusing on four dimensions: organizations, characteristics, organizational culture and internal control efficiency. Organizations, characteristics, organizational culture and the efficiency of internal control, the results showed that cooperatives are positively influenced by efficient internal control in organizational structures. (Shafie et al., 2019).

In a research paper conducted in Vietnam, the objective was to determine the impact of internal control system and profitability. They evaluated the positive or negative effects of the application of IC in SMEs in the manufacturing sector in Vietnam. The methodology applied is quantitative approach, conducted in 10 provinces in Vietnam, which includes more than 2500 SMEs surveyed, concluding that the implementation of internal control has a positive effect, also play a very important role in promoting the profitability of enterprises, thus reducing violations, risks and bribery (Vu & Thuy., 2021).

Dicu et al., (2019) in their scientific research, where the main objective is to determine the relationship of profitability ratio indicators with respect to return on assets, return on capital and return on sales calculated over a period of 10 years in industrial companies in Romania. The methodology is of quantitative approach and the instruments applied are: survey, questionnaire and documentary analysis. The conclusion is that the return on sales is stronger and that there is a positive relationship.

Zimon et al. (2021), in their research conducted on 108 Iranian manufacturing companies participating in Tehran stock exchange between 2013 - 2018, mainly aimed to examine the different types of earnings managements and the role of internal control procedures. The applied method is descriptive correlation and is aimed at multi-purpose application, utilization of combined data collection (panel/combined), they came to the conclusion that an adequate corporate internal control system is favorable which will prevent opportunistic behaviors of their executives in times of crisis.

In the studies conducted on accounting systems and internal controls; quantitative approach, where they sought to determine the timeliness and accuracy of financial accounting information in cooperatives, the samples conducted were 60 cooperative institutions in Tangerang City, Indonesia simple random sampling study. Data were also collected through questionnaires using Likert scale. The results showed that accounting information systems had a positive effect on the timeliness, accuracy, as well as usefulness to users for the delivery of financial statements. They concluded that teamwork, compliance with internal controls and adequate coordination positively affect cooperatives (Mardi et. al., 2020).

The objective of the research was to analyze the cash management strategies that have an impact on the profitability of the entities' economies. The methodology applied is quantitative, correlational, panel data method, the financial information of 31507 commercial companies and 11008 manufacturing companies of the years 2012-2017 was taken from their financial statements, obtaining as results a positive effect on the relationship of management strategies, concluding that any strategy to manage cash in all sectors is essential to obtain a good financial profitability. (Muyma & Rojas.,2019)

For Azula and Guevara (2018), they conducted research to a transport company, with the purpose of evaluating the relationship between internal control and profitability. The type of study was descriptive, non-experimental, carrying out a questionnaire of 38 questions to the workers of the company. Finally, they conclude that internal control has a direct impact on the profitability of the company, because there is no adequate control of the processes.

Alva and Avalos (2021), in their research, whose main objective was to determine the effect of internal control on the profitability of the transport services company. The methodology used in this study of quantitative approach, cross-sectional type and scope was descriptive, the instruments used for data collection is the questionnaire and the interview which were applied to employees of the company, as well as documentary analysis in order to determine the profitability. The result was that there is a high profitability because they have an adequate internal control, only 80% of the workers are aware of the internal control and its dimensions. Thus concluding that there is a positive effect between internal control and profitability.

In a scientific paper conducted in Indonesia, aimed to scrutinize how internal control influences leadership, style and teamwork, quantitative approach, conducted to at least 110 employees through a survey instrument was questionnaire, the data was examined using SPSS. Showing as a result that internal control and teamwork positively influence the success of projects (Gui et al., 2019)

In the scientific article of the Latin American economy in the SME sector, where it occupies a large and growing place, this research aims to analyze the capital structure, and the variation of profitability according to their sources of financing of medium-sized corporate enterprises in Ecuador. The type of study is of quantitative approach, the information collected is from 168 companies in the province of Loja, from the Superintendence of Companies of Ecuador. The study concluded that the relationship between liquidity and indebtedness is low in terms of economic and financial profitability. On the other hand, solvency and size have a significant influence on the organizational structures of the companies (Cueva et al., 2017)

Likewise, Araujo (2019), in his research carried out in a service company in Trujillo, proceeded to interview the manager and then carried out questionnaires with the collaborators, obtaining as results that the management knew about these bad management and procedures in their areas, affirming that there is no administrative control due to the lack of preparation and training of their bosses. The conclusion was that there is a deficiency in the areas of human talent which affects the profitability of the company due to the lack of training and adequate information.

Adegboyegun et al., (2020) who developed their research focusing on the impact of internal control system components on profitability by sampling 120 SMEs. Through a questionnaire, the results showed a high level of performance, finally concluding that companies should be more committed to integrity, ethical value, competence, accountability, as well as to the development of preventive control activities through the involvement of technology.

Ewert and Wagenhofer (2020), where they mention that internal control over financial reporting has gained increasing regulatory attention, its implementation is far from perfect; therefore, firm-specific incentives for management become important to increase the quality of financial reporting. These studies recommend or conclude to invest in accounting quality, even if it is costly to do so.

According to the regulations of Law No. 28716, internal control consists of the actions of prior prevention, when it is in process and final evaluation, provided that the private or state company is subject to internal control, in order to properly manage its resources, assets and operations, is carried out according to established procedures. Ministry of Economy and Finance (MEF, 2018), We also consider the International Standard on Auditing (ISA, 400), which establishes the procedures, guidelines to obtain a better understanding of the accounting and internal control systems, also provides information on audit risks and their components.

Conceptual Framework

Regarding the definitions of the internal control variable, Robalino et al., (2018) cited that internal control is designed and led by its top executives, administrative in order to minimize the risks of the companies detected as a threat in the fulfillment of its objectives with this to achieve the credibility of financial information. Espinoza et al., (2018) mention that internal control is a support tool to manage and achieve the required quality in companies and organizations, as well as the responsibilities of all members of the institution. Koutoupis and Malisiovas (2021) the widespread economic crisis, widely publicized fraud and the need for a stable system for companies, have made entities put more emphasis on the role of internal control systems, as well as their respective components and this positively affects profitability.

According to the Committee of Sponsoring Organizations of the Treadway Commission (COSO, 2013), internal control supports organizations in protecting and optimizing the achievement of their objectives and goals, encouraging entities to adapt to operational changes. It is the monitoring of the methods, procedures and policies adopted by the company's management in order to achieve the institutional objectives in an efficient and effective way, helping to prevent and mitigate risks in the organization.

Supported by the COSO (2013), they determine the five components as dimensions for this study: the first dimension is defined as the control environment, actions, procedures, policies and attitudes within an organization, administrative management, owners where the objectives are set, allocate resources, according to the structure of the organization for the fulfilment of internal control (Camacho et al., 2017); The second dimension, risk assessment, is when management knows and addresses the risks faced both internally and externally, where the objectives are set, in all structures of the organization, to work in coordination (Quinaluisa et al., 2018); The third dimension is the component, control activities, which are the policies, systems and procedures that the company has to carry out at all levels, which will help to minimize risks in order to fulfil the company's objectives and mission (Vega et al., 2017); The fourth dimension is the component, information and communication, which is vital and important for the processing of reliable and timely information. It also establishes means of communication to know and become aware of their responsibilities to those who work in the company (Gaviria & Castellanos, 2018), as the fifth and final dimension is the monitoring component, which is the continuous and independent reviews and evaluations with which it is determined that the components are working properly.

In research, profitability is defined as the earnings of a company that are generated from revenues after deducting all expenses incurred during a given period (Alarussi & Alhaderi, 2018). On the other hand, profitability comes to be the ability to achieve a surplus once fulfilled its obligations in relation to the investments made by a company or any type of economic activity (Daza, 2016). In addition, profitability is the benefits or profits that are generated, after measuring the financial statements, depending on the sources of financing. Where the dimensions were considered, return on assets (ROA), which is the degree of efficiency of total assets to generate income, the second dimension is return on equity (ROE), which measures the benefits that have been achieved in the investments of the owners (Cueva et al., 2017); another dimension is also considered return on capital employed (ROCE), it allows investors to determine the efficiency with which the management of a company generates profits on the investment made by shareholders and creditors (Ofoegbu & Odoemelam, 2018); finally, there is the return on sales (ROS), where it efficiently measures the profits from the revenues generated from an organization (Hyblova & Skalicky, 2018).

In the studies carried out to define the profitability variable, it measures the relationship between an economic activity and the means used to obtain profits (Gallizo, 2017), also considers that it is important to analyze the factors involved in profitability, aiming to maximize the wealth of its shareholders, increasing the value of its business and maximizing income (Spitsin et al., 2017), 2017). of which focuses on two factors of major importance, return on assets (ROA) or return on investment (ROI) which comes to be return on assets, and is defined as net income between total assets and return on equity (ROE) Equity rate of return is represented as net income between equity capital According to (Bondoc & Dumitru 2018).

Methodology

Applied research, because the objective of the research seeks a solution to the problem, and to this end, information is consolidated and searched for so that it can be applied and thus enhance scientific and cultural knowledge.

According to the approach, this research is quantitative, as numerical data from the financial statements are analyzed for the study of profitability.

According to the scope of this research, it is descriptive because it will analyze trends and characteristics of both the respondents for the study of internal control and the data from the financial statements for the study of profitability. Furthermore, it is descriptive because it is also quantitative research, so the data must be analyzed in an objective way, without subjecting it to experiments.

According to the temporality, it was a cross-sectional study, because data collected over a period of time on a predefined sample will be analyzed.

In this research, a non-experimental cross-sectional design was used, with a descriptive scope since the study variables are not modified or manipulated, but on the contrary, it is responsible for collecting information that describes and analyses the behavior of our variables and thus achieve the objectives (Hernández-Sampieri & Mendoza 2018).

Population: The study population consists of 50 workers of the general services company, Chosica, 2021. The sample consisted of 16 workers from the administration, accounting, treasury, finance, logistics and operations areas, who are directly related to the company's problems. The financial statements for the financial years 2020 and 2021 were considered as the unit of analysis.

Data collection techniques and instruments

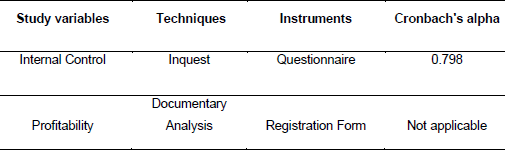

Table 1

Techniques and instruments used in this study

Note. Own elaboration.

Reliability

To demonstrate the reliability of the questionnaire, the pilot test was conducted and Cronbach's Alpha was applied, If it is reliable because it passed with a result obtained greater than 0.798. According to Hernández et al. (2014) define reliability as the different procedures to measure the reliability of the measurement instrument.

Procedures

The relevant arrangements were made for the validity of the instruments to be applied. In the second stage, the data collection process was carried out by means of a virtual questionnaire (google forms), followed by the documentary analysis based on the information provided, with the prior authorization of the management. The data was then collected, processed and analyzed.

Data analysis method

The method of data analysis for the first variable, internal control, was developed by means of a questionnaire and the information was validated using Excel and SPSS. According to José Manuel Becerra Espinosa where he mentions that it is responsible for showing information in specific data such as quantities of a population and for the second variable, profitability, the documentary analysis of the information that the company has such as the financial statements for the periods, 2019, 2020 and 2021, whose instrument was the documentary analysis sheets, was carried out.

Results

After collecting information and using the survey technique by applying a questionnaire as an instrument for the first variable, documentary analysis was also carried out for the second variable in order to respond to the objective.

Level of internal control in general services company

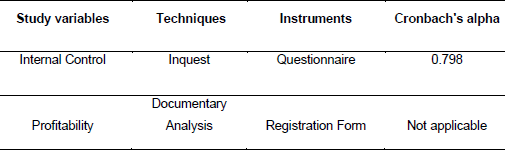

Table 2

Level of internal control in the Chosica general services company, 2021

Note. ni= Number of surveys, % = Percentage.

The level of application of internal control in a general services company in Chosica, 2021, is determined at a low level, with 62% of the workers surveyed considering that the company has a low level of internal control, while 38% consider it to be at a medium level. Likewise, in the control environment dimension, 69% of the employees surveyed identified it as low and 31% considered it to be at a medium level. As for the risk assessment dimension, 38% of the employees identified it as low and 62% considered it to be at a medium level; With regard to the control activities dimension, 88% of the employees considered it to be at a low level and 12% considered it to be at a medium level; the information and communication dimension, 88% of the employees said it was at a low level and 12% considered it to be at a medium level; and finally, with regard to monitoring, 62% of the employees considered it to be at a low level and 38% considered it to be at a medium level.

These results coincide with Vega et al. (2017) in their research they addressed the levels to evaluate internal control, as well as the maturity and its effectiveness as Initial, basic, Satisfactory, Advanced and optimized. In this entity under study, internal control is found at a satisfactory level of (24%) and a basic level of (76%) as detailed by those who work in the company, the process of labor linkage for formality is not given correctly, likewise the staff training is not adequate or simply not performed. Also. Mardi et. al. (2020) found that teamwork and internal control have a positive and significant effect on the timeliness of delivery of financial statements. This shows that better team coordination leads to a proper presentation of financial statements. It also shows that the more effective the internal control, the more timely the delivery of financial statements. Similarity is also found with Shafie et al., (2019) and Gui et al., (2019) who investigate the effectiveness of internal control by focusing on its dimensions. Thus concluding the positive influence of internal control in cooperatives. However, it differs with the research of Ewert and Wagenhofer (2020), they consider that an accounting system should be implemented conservatism instead of internal control, investing in accounting quality the benefits is higher, believes that accountants, managers should be trained and considers that the implementation of internal controls is far from perfect.

Profitability analysis in a general services company

Table 3

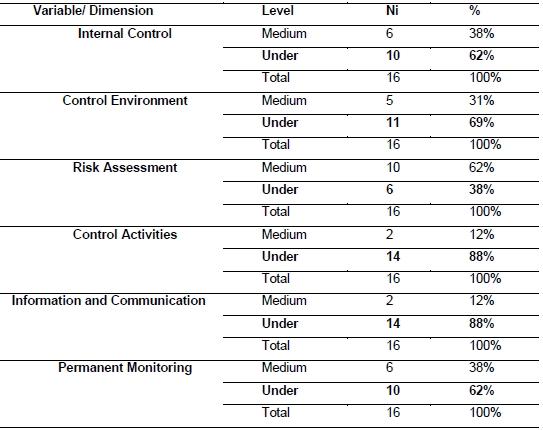

Statement of Financial Position of general services, Chosica, in the years 2019, 2020 and 2021, expressed in Soles.

Note. Own elaboration.

The horizontal analysis of the Statement of Financial Position from 2019 to 2021 shows a significant increase in the period 2021 with respect to 2020 from S/ 14,738.00 to S/ 174,054.00, an increase of S/159,676.00 which represents an increase of 1110.56% of cash and cash equivalents; this is due to the fact that the trade receivables of the previous period were cancelled and that the decrease of S/ 513,319 to S/126,980, which represents a -75.26% with respect to 2020; in the same way an increase in auxiliary materials, supplies and spare parts is observed in order to increase the level of sales, by 264.82%; with respect to the year 2020; as for the Real estate, machinery and equipment there is a decrease in -24.7% this means that they did not renew new acquisitions for the following year, as a result in total assets decreased for the year 2021 by minus 35.93%; and as for liabilities and equity a payment is made to shareholders in the period 2021, S/ 223,531; and this as a result in total liabilities and equity decreased by -35.93% with respect to the year 2020. It is determined that the lack of efficient internal control was not achieved to the expected results, which is evidenced by a decrease of S / 7,152, which comes to be - 12.11% of profit obtained in the period 2021, compared to the period 2020.

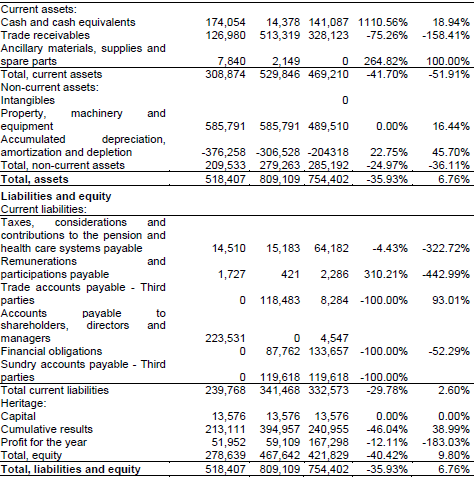

Table 4

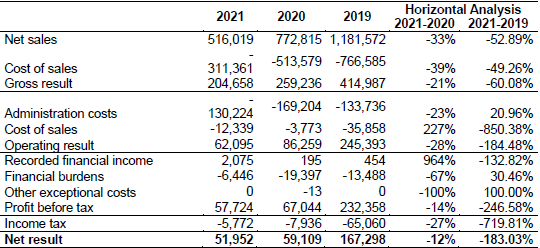

Statement of results of general services, Chosica, in the years 2019, 2020 and 2021, expressed in Soles.

Note. Own elaboration.

In the income statements for the periods 2021, 2020 and 2019. the horizontal analysis is presented, where it can be seen in the period 2021, there was a decrease of 33% in net sales, compared to the period 2020. in the same way it can be seen that there is a considerable decrease in 2020 compared to 2019, in terms of administrative expenses there was a lower expenditure by 23%, compared to the period 2020; On the other hand, in terms of selling expenses there was an increase of 227%, in terms of the results of the period 2021 there was a decrease compared to 2020 by 12%.

Table 5

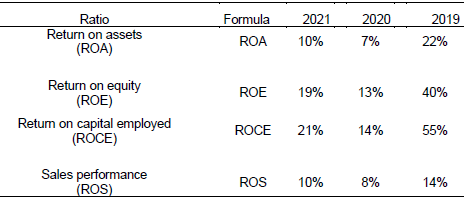

Financial Ratios for general services, Chosica, in 2019, 2020 and 2021

Note. Own elaboration.

The ratios index has been obtained by means of the financial formulas applied, with respect to ROA for the year 2021, 10%, 2020, 7% and 2019, 22% respectively. In addition, there is a slight increase in profitability of 3% higher than in 2020 and a reduction of 12% in the return on assets employed per company to generate profits compared to 2019. Regarding the second dimension ROE, the results are in 2021, 19%; 2020, 13% and 2019, 40% comparatively, where they obtained a higher level in 2019 which is 40%, while the following years decreased considerably, mainly in 2020, by 27% less. This is in addition to the state of sanitary emergency and other internal shortcomings. The third ROCE indicator shows the results 2021, 21%; 2020, 14% and 2019, 55%, where it can be seen that in 2019 a good investment of the capital employed was made. Finally, in the last indicator ROS, where the index on sales was measured where it is observed, for 2021, 10%; 2020, 8% and 2019%, 14% respectively, where there were better results is in the period 2019, and thus it is determined. that in the period 2019 and obtained the best results.

The results of this research coincide with Muyma and Rojas (2019), who by means of ROA and ROE seek the existence of a direct, positive relationship in terms of profitability analysis that efficiently employs all the factors that intervene on assets and equity to obtain better results in companies. It also agrees with Bondoc and Dumitru (2018), who in their research examined the performance of Romanian companies through profitability indicators, which resulted in the conclusion that financial and economic ratios are of paramount importance to measure the performance of a company.

Effect of internal control on profitability in a general services company

The level of internal control was identified through the application of the survey and the analysis of the financial statements through the indexes that measure the profitability through the ratios for the periods 2020 and 2021 where it is evident that the effect of internal control in the profitability is positive since it shows the following results, comparing the periods 2020 and 2021, the profitability of the company has a slight increase in terms of ROA: 7%, 10% in the same way the ROE: 13%, 19%, followed by ROCE 14%, 21% and finally the ROS: 8%, 10%. From the survey of the company's employees, it was found that internal control is at a low level with a percentage of 62%. This means that the entity is not within the desired parameters according to the objectives of the organization, likewise in the dimension of control activity and information and communication are at a low level with 88%, with respect to the other dimensions, we have control environment with 69% at a low level; permanent monitoring 62% at a low level; control activities and risk assessment in 38% at a low level; whose results show that there are shortcomings in the organization as they are not taking measures to improve the deficiencies that are evident. Likewise, for profitability, a horizontal analysis of the statements of financial position was performed, which shows an increase in cash and cash equivalents in 2021, compared to 2020, which reaches 1110.56%, where it is reflected that the customer portfolio decreased considerably in 2021, to -75.26%, so it is observed that they did not invest in assets where the same amount is maintained, compared to the 2020 period. Also, a comparison of the periods of 2019 and 2021 was made, which shows a considerable decrease due to the deficiency of internal control and added to this the health crisis that the country went through the Covid 2019, affecting the results of the company, according to the indexes that measure profitability through the ROA ratios: 22%, 10% likewise ROE: 40%, 19%, followed by ROCE: 55%, 21% and finally the ROS: 14%, 10%. This shows that the company has lost effectiveness and efficiency in its activities, thus presenting problems within its internal controls.

Finally, in the research carried out from a more general perspective, it can be seen that variable 1, which is internal control, directly affects variable 2, which is profitability.

These results are in line with Adegboyegun et al, (2020) who detail the impact of internal control system components on the profitability of the companies, using a sample of 120 SMEs. Using a questionnaire, the results showed a high level of operational performance in terms of higher real annual profit increases insignificantly by 0.78% and 1.95% respectively. This study concludes that companies should commit themselves more to integrity, ethical value, competence, accountability, as well as to the development of preventive control activities. According to Alva and Avalos (2021), in their research, where they establish the effect of internal control is essential to achieve the profitability desired by the company. They found that there is adequate internal control, together with high profitability, but only 80% of employees are aware of internal control and its dimensions. Thus concluding that there is a positive effect between internal control and profitability, obtaining 18% profitability. These results are similar to those of Araujo (2019) and Azuela and Guevara (2018), where they conclude that internal control compliance has a direct impact on the profitability of service companies.

CONCLUSIONS

It is concluded that internal control has a positive effect on the profitability of the general services company of Chosica-2021. The analysis of the financial ratios showed that as internal control improves, profitability is directly affected and therefore better results are obtained. As for the internal control variable is at a low level, reducing the company's profits by S/. 7,157.00, in the period 2021 compared to the period 2020, and S/. 115,346.00 bought to the period 2019, this is due to deficiencies in the implementation of its internal controls, as well as the constant inefficiency in terms of the component of control activity and information and communication, as well as monitoring of activities that develop the company. Thus, concluding that internal control compliance has a direct impact on the profitability of service companies. In this sense, from the research reviewed and analyzed the results, it is verified that an efficient and well implemented internal control has a positive result and this makes the companies have a good profitability to guarantee the economic stability of the company.

It was identified that the level of internal control is at a low level with a percentage of 62% and 38% at a medium level at the variable level, which means that the company is not correctly developing the control of its activities, likewise the lowest levels are found in the components of control activities and Information and communication at 88% low level and 12% at medium level, followed by Control environment, permanent monitoring and risk assessment, This is due to the lack of greater emphasis on the part of management for compliance and execution of internal controls, there are shortcomings in terms of the allocation of their functions, which is why every organization should implement an internal control according to the size of the company and the operations it performs, in such a way that will allow to improve the information processes in real time and in a timely manner, as this will avoid and help to minimize risks.

The analysis of the profitability of a general services company, for the periods 2021 to 2019, was carried out by applying the calculation of financial and economic ratios, obtaining as results that in 2019, in terms of asset management, 22% was obtained, while in 2020 it decreased by 7% and in 2021, 10%. Likewise, in the return on equity there was a good performance in 2019, with 40%, while in the period 2020, decreases by 13% and 2021, 19%, in terms of capital employed there is a profitability for 2019, 55% and decreased for 2020 by 14% and 2021, 21%. In terms of profitability on sales, the best results were obtained in the period 2019 obtaining 14%, and decreasing in 2020 by 8% and 2021 by 10%. In this way, it can be concluded that profitability in the last two years has decreased considerably in the company due to its shortcomings in its controls, in addition to the health crisis that the country went through due to the pandemic. It is thus recommended to evaluate or calculate correctly and annually the profitability of the general services company, so that they can have the information in time and make the right decisions. As well as investing in technological resources or goods, but in this case it is recommended to prioritise investment in staff, which will help the company in its growth and development and this will be reflected in the market and thus obtain the necessary attraction of customers and thus increase the profits of the company.

REFERENCES

Please refer to articles in Spanish Bibliography.

BIBLIOGRAPHICAL ABSTRACT

Please refer to articles Spanish Biographical abstract.